Running a small business can be financially rewarding, but it also comes with its fair share of expenses. As a self-employed individual, it’s important to keep track of your expenses to maximize your tax deductions and minimize your tax liability. One way to stay organized is by using a printable self-employed tax deductions worksheet.

With a self-employed tax deductions worksheet, you can easily track all of your business expenses throughout the year. This can include everything from office supplies and equipment to travel expenses and marketing costs. By keeping detailed records, you can ensure that you are taking advantage of all the deductions available to you come tax time.

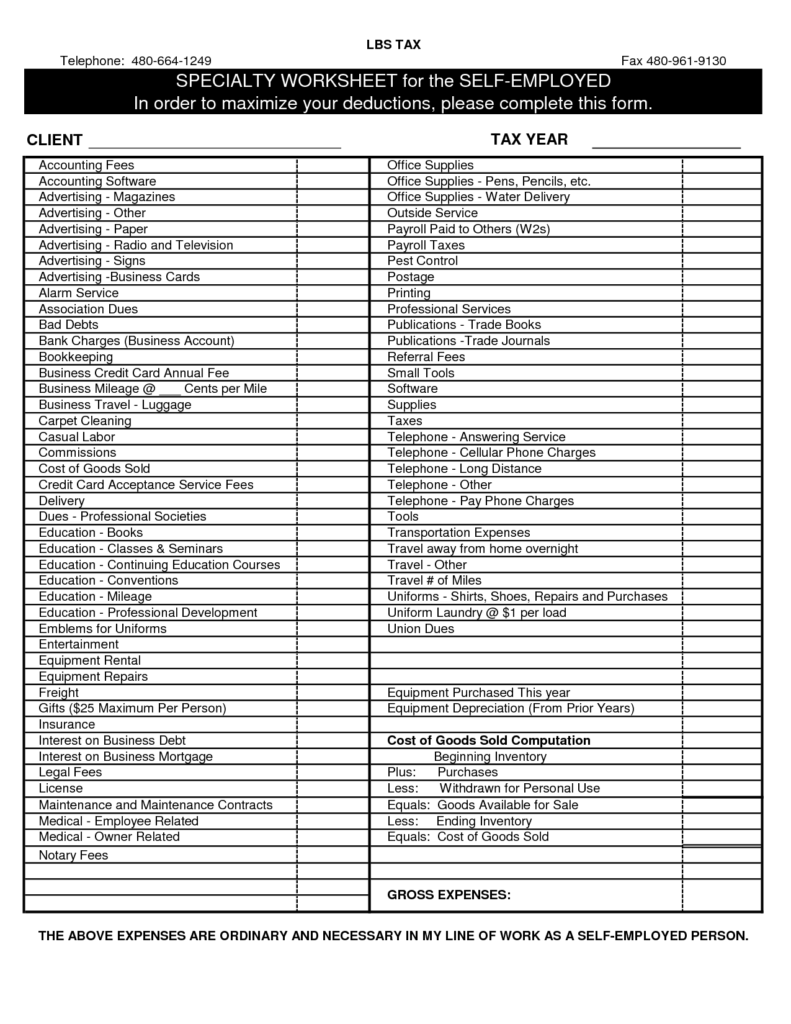

Small Business Expenses Printable Self Employed Tax Deductions Worksheet

Small Business Expenses Printable Self Employed Tax Deductions Worksheet

When using a printable worksheet, you can categorize your expenses and keep track of them in an organized manner. This makes it easier to calculate your total deductions and report them accurately on your tax return. Additionally, having a worksheet can help you identify any expenses that you may have overlooked or forgotten about.

Some common expenses that self-employed individuals can deduct include home office expenses, professional fees, advertising costs, and insurance premiums. By using a printable worksheet, you can easily track these expenses and ensure that you are claiming all the deductions you are entitled to. This can ultimately help you save money on your taxes and keep more of your hard-earned income.

In conclusion, a self-employed tax deductions worksheet can be a valuable tool for small business owners looking to maximize their deductions and minimize their tax liability. By keeping detailed records of your expenses throughout the year, you can ensure that you are taking advantage of all the deductions available to you. Consider using a printable worksheet to stay organized and make tax time a little less stressful.