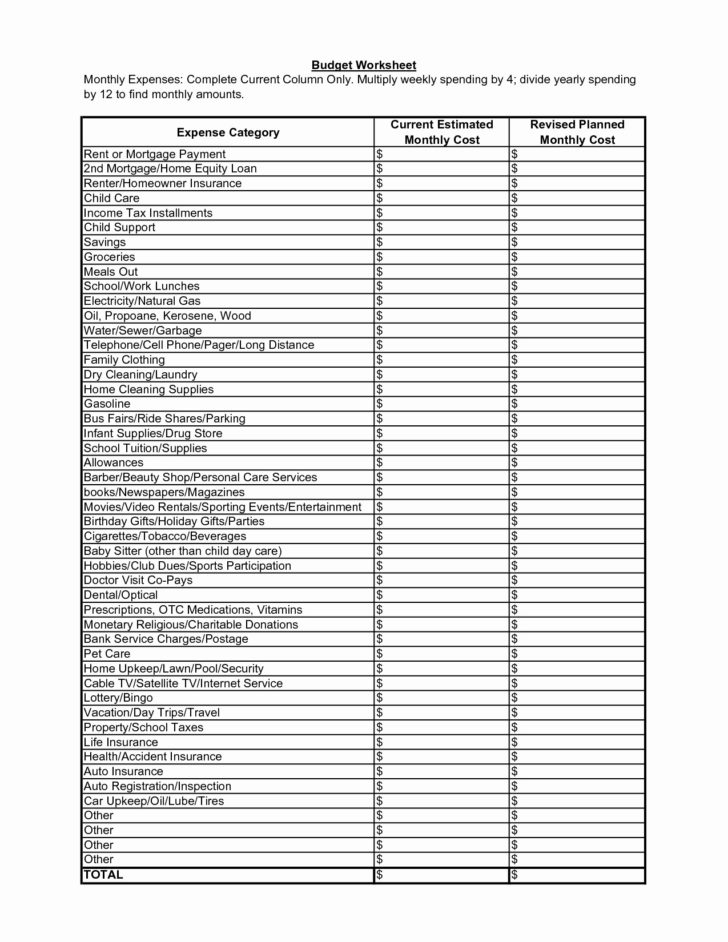

As a small business owner, keeping track of your expenses is crucial for maximizing your deductions come tax time. One way to organize and categorize your expenses is by using a Printable Schedule C Expenses Worksheet. This tool can help you stay organized and ensure you don’t miss out on any deductible expenses.

By utilizing a Printable Schedule C Expenses Worksheet, you can easily track all of your business expenses in one place. This worksheet is specifically designed to help you categorize your expenses according to the IRS Schedule C form, making it easier to report them on your tax return.

Printable Schedule C Expenses Worksheet

Printable Schedule C Expenses Worksheet

Printable Schedule C Expenses Worksheet

With a Printable Schedule C Expenses Worksheet, you can categorize your expenses into different categories such as advertising, supplies, travel, and utilities. This helps you keep track of all your deductible expenses and ensures you don’t miss out on any potential deductions.

Additionally, using a Printable Schedule C Expenses Worksheet can help you identify areas where you may be overspending or where you can cut costs. By analyzing your expenses in a systematic way, you can make informed decisions about your business finances and potentially save money in the long run.

Another benefit of using a Printable Schedule C Expenses Worksheet is that it can save you time and stress when it comes time to file your taxes. By having all of your expenses neatly organized and categorized, you can easily transfer this information onto your Schedule C form without any last-minute scrambling.

In conclusion, a Printable Schedule C Expenses Worksheet is a valuable tool for small business owners looking to maximize their deductions and stay organized when it comes to tracking expenses. By utilizing this worksheet, you can ensure that you are taking full advantage of all deductible expenses and potentially saving money on your taxes. So why wait? Start using a Printable Schedule C Expenses Worksheet today and take control of your business finances.