Managing household expenses can be a challenging task, especially when you have multiple bills and payments to keep track of. A printable monthly household expense sheet can help you stay organized and monitor your spending habits effectively. By using this tool, you can track your income, expenses, and savings easily.

With a printable monthly household expense sheet, you can create a budget that aligns with your financial goals and priorities. This sheet allows you to categorize your expenses, such as groceries, utilities, rent/mortgage, transportation, and entertainment. By tracking your expenses in each category, you can identify areas where you may be overspending and make adjustments accordingly.

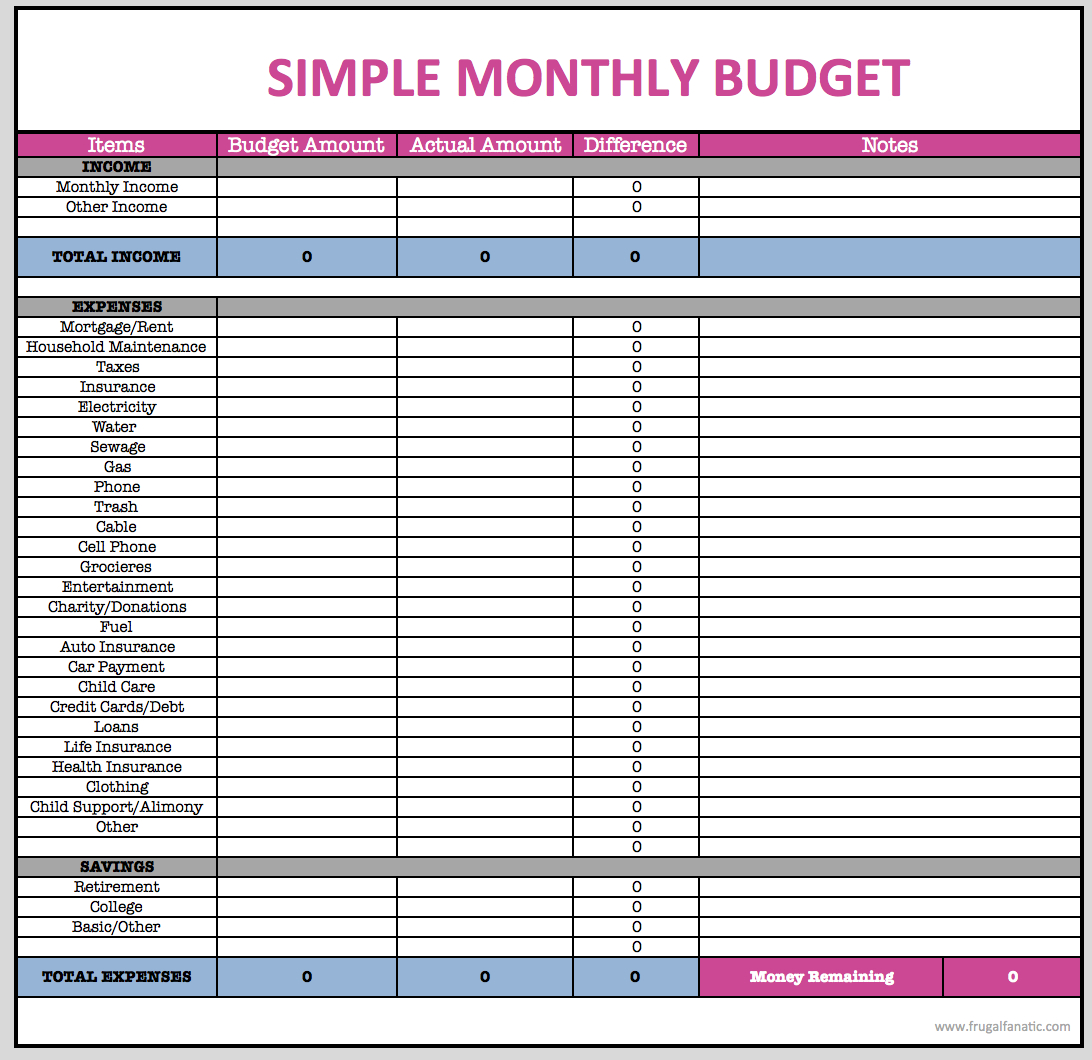

Printable Monthly Household Expense Sheet

Printable Monthly Household Expense Sheet

One of the key benefits of using a printable monthly household expense sheet is that it provides a visual representation of your financial situation. You can see how much money is coming in, how much is going out, and how much you are saving each month. This visibility can help you make informed decisions about your spending habits and identify opportunities to save money.

Another advantage of using a printable monthly household expense sheet is that it can help you plan for future expenses and emergencies. By tracking your expenses over time, you can anticipate upcoming bills and create a savings plan to cover unexpected costs. This proactive approach to financial management can help you avoid financial stress and achieve your long-term financial goals.

In conclusion, a printable monthly household expense sheet is a valuable tool for managing your finances and achieving financial stability. By tracking your expenses, creating a budget, and monitoring your savings, you can take control of your financial future and make informed decisions about your money. Whether you are saving for a major purchase, planning for retirement, or simply trying to stay within your budget, a household expense sheet can help you reach your financial goals.