Managing your finances is an essential part of maintaining a healthy financial future. One way to keep track of your income and expenses is by using a printable income expense worksheet. This tool can help you monitor where your money is going, identify areas where you can cut back, and ultimately reach your financial goals.

Creating a budget and sticking to it can be challenging, but with the help of a printable income expense worksheet, you can easily see where your money is going each month. This can help you make informed decisions about your spending habits and prioritize your expenses.

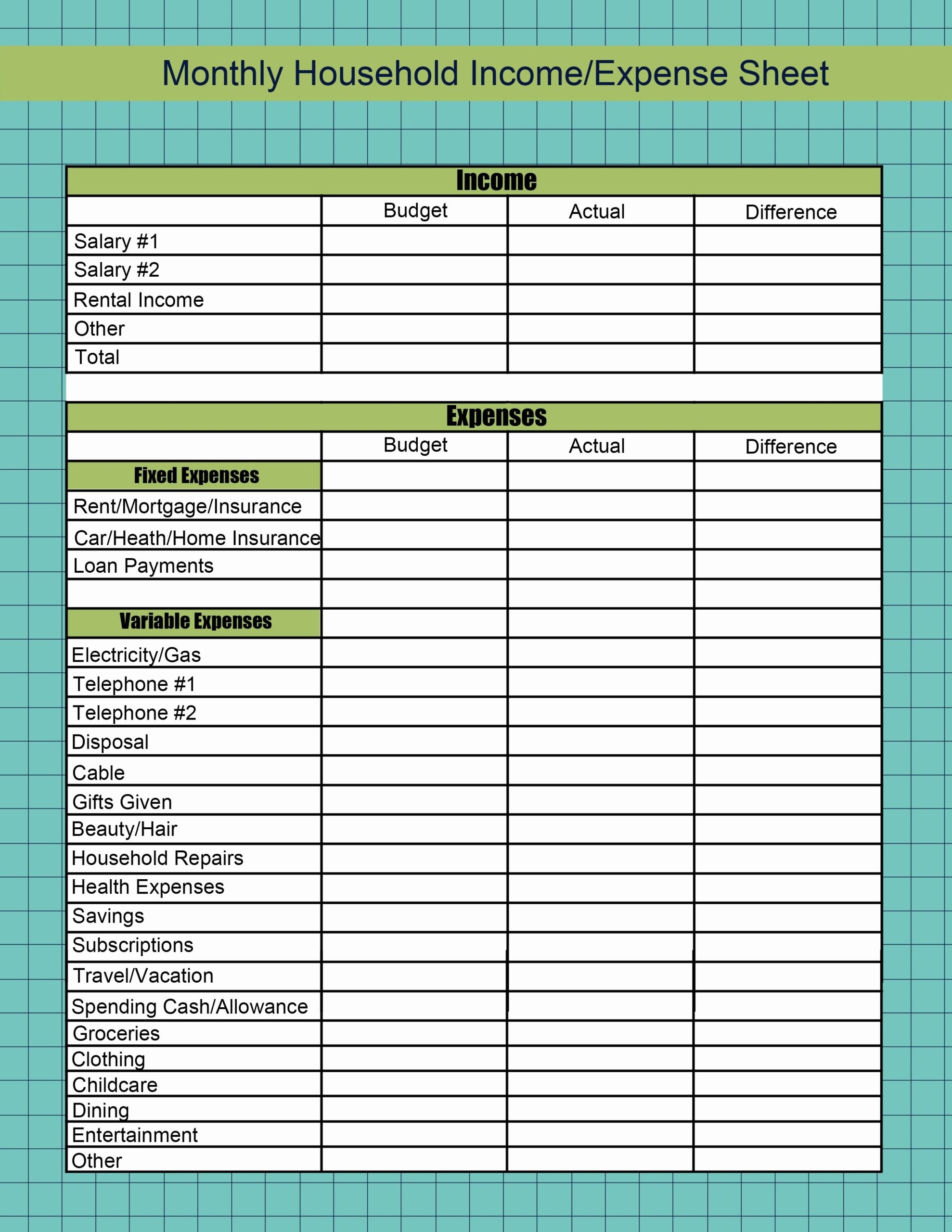

Printable Income Expense Worksheet

Printable Income Expense Worksheet

Printable Income Expense Worksheet

A printable income expense worksheet typically includes categories for both income and expenses. You can list all sources of income, such as salary, bonuses, or side hustles, and then detail your expenses, including rent, utilities, groceries, and other discretionary spending. By tracking these numbers, you can calculate your net income and see if you are living within your means.

Moreover, a printable income expense worksheet can also help you identify areas where you can cut back on spending. By categorizing your expenses, you can see which areas are taking up a significant portion of your income. This can help you make informed decisions about where you can reduce your spending and save more money for the future.

Another benefit of using a printable income expense worksheet is that it can help you set financial goals and track your progress over time. By comparing your actual expenses to your budgeted expenses, you can see where you may be overspending and make adjustments accordingly. This can help you stay on track with your financial goals and make necessary changes to improve your financial situation.

In conclusion, a printable income expense worksheet is a valuable tool for managing your finances and reaching your financial goals. By tracking your income and expenses, you can make informed decisions about your spending habits, identify areas where you can cut back, and ultimately achieve financial success. So, why not give it a try and start tracking your finances today?