Managing your finances effectively is crucial for maintaining financial stability and achieving your financial goals. One tool that can help you keep track of your income and expenses is a printable income and expense ledger. This simple and convenient tool allows you to monitor your cash flow and identify areas where you can save money or increase your income.

Keeping a detailed record of your income and expenses is essential for budgeting and financial planning. By using a printable income and expense ledger, you can easily track your earnings and expenditures on a regular basis. This can help you identify patterns in your spending habits and make informed decisions about where to cut costs or increase your income.

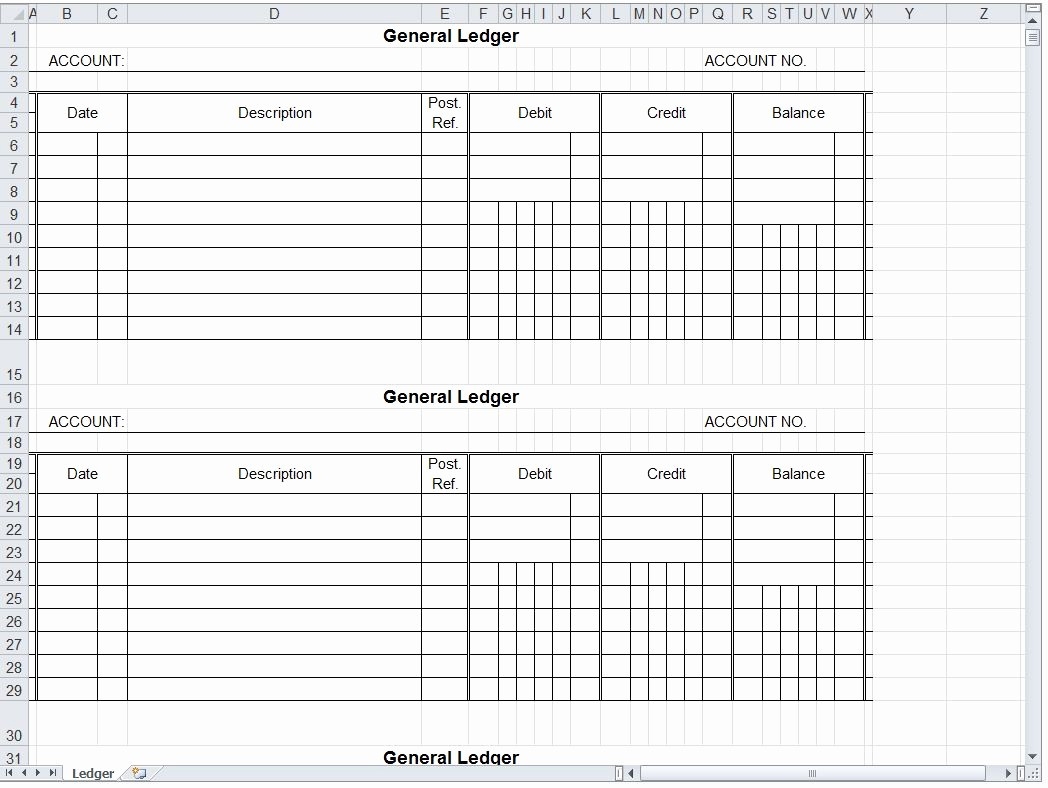

Printable Income And Expense Ledger

Printable Income And Expense Ledger

With a printable income and expense ledger, you can categorize your income and expenses into different sections, such as income sources, fixed expenses, variable expenses, savings, and investments. This can give you a clear overview of your financial situation and help you prioritize your spending and saving goals. By regularly updating your ledger, you can stay on top of your finances and make adjustments as needed.

Another benefit of using a printable income and expense ledger is that it provides a tangible record of your financial transactions. This can be helpful for tax purposes, as well as for monitoring your progress towards your financial goals. By keeping a detailed ledger, you can easily refer back to previous months’ records and track your financial growth over time.

In conclusion, a printable income and expense ledger is a valuable tool for managing your finances effectively. By keeping track of your income and expenses in a systematic way, you can make informed decisions about your financial priorities and goals. Whether you are looking to save money, pay off debt, or increase your income, a printable income and expense ledger can help you stay organized and on track towards financial success.