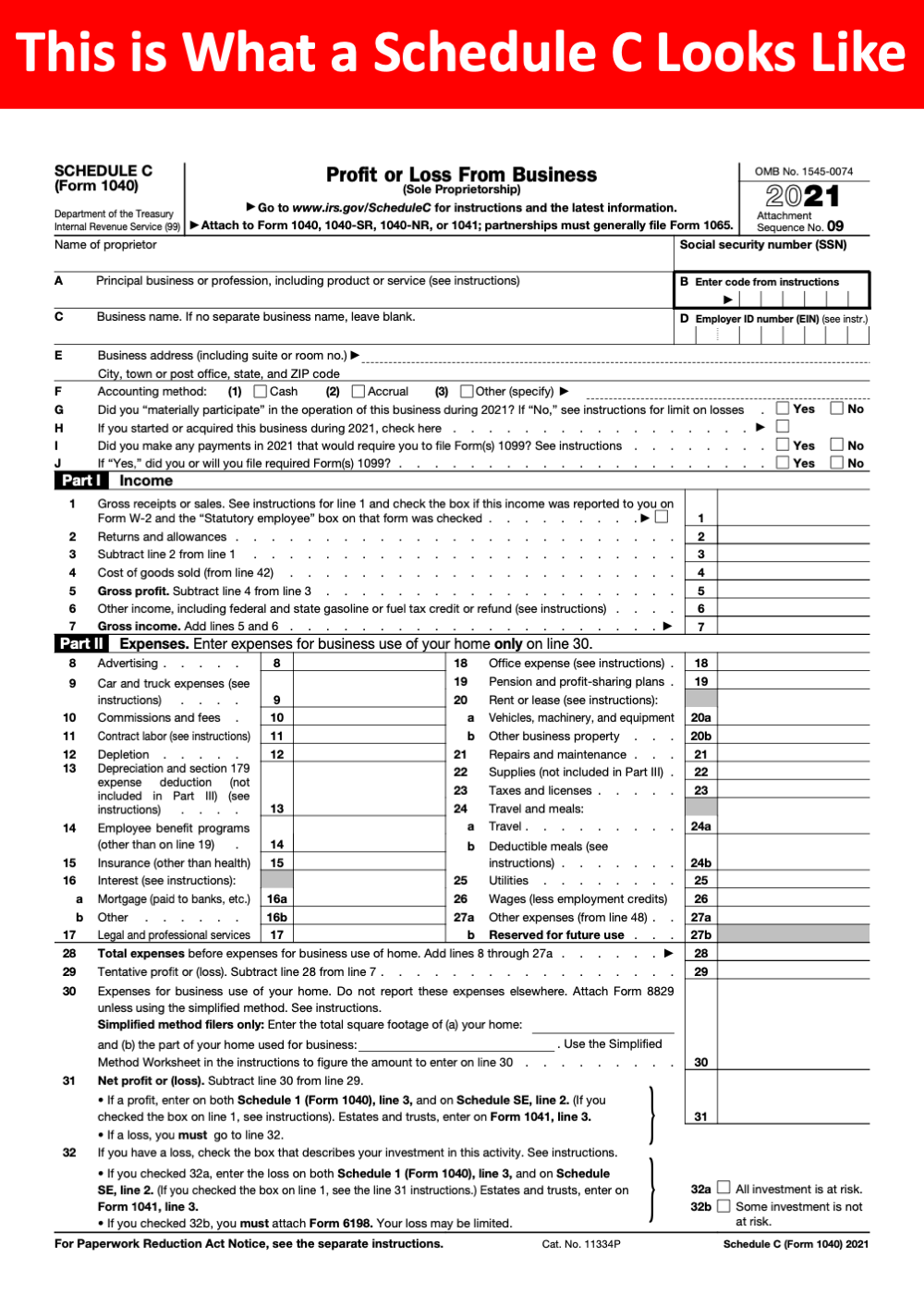

Keeping track of expenses is crucial for any business owner, especially when it comes to tax time. One way to organize and report your business expenses is through Schedule C, which is used to report income or loss from a business you operated or a profession you practiced as a sole proprietor. This form is submitted along with your annual tax return.

Printable forms of Schedule C expenses are available online, making it easier for business owners to keep accurate records of their expenses throughout the year. These forms typically include categories such as advertising, supplies, utilities, rent, and more, allowing you to easily input your expenses and calculate your total deductions.

Printable Form Of Schedule C Expenses

Printable Form Of Schedule C Expenses

When using a printable form of Schedule C expenses, it’s important to ensure that you accurately categorize and document each expense. This will not only help you stay organized throughout the year but also make it easier to fill out your Schedule C form come tax time. Keeping detailed records of your expenses can also help you identify areas where you can cut costs and improve your overall financial health.

By utilizing a printable form of Schedule C expenses, you can streamline the process of tracking and reporting your business expenses. This can save you time and stress when it comes to preparing your taxes and ensure that you are taking advantage of all available deductions. Whether you are a freelancer, independent contractor, or small business owner, keeping accurate records of your expenses is essential for maintaining financial stability and compliance with tax laws.

In conclusion, printable forms of Schedule C expenses are a valuable tool for business owners looking to organize and report their expenses effectively. By utilizing these forms, you can keep track of your expenses throughout the year, easily calculate your deductions, and ensure that you are in compliance with tax laws. Take advantage of printable forms to simplify your record-keeping process and stay on top of your business finances.