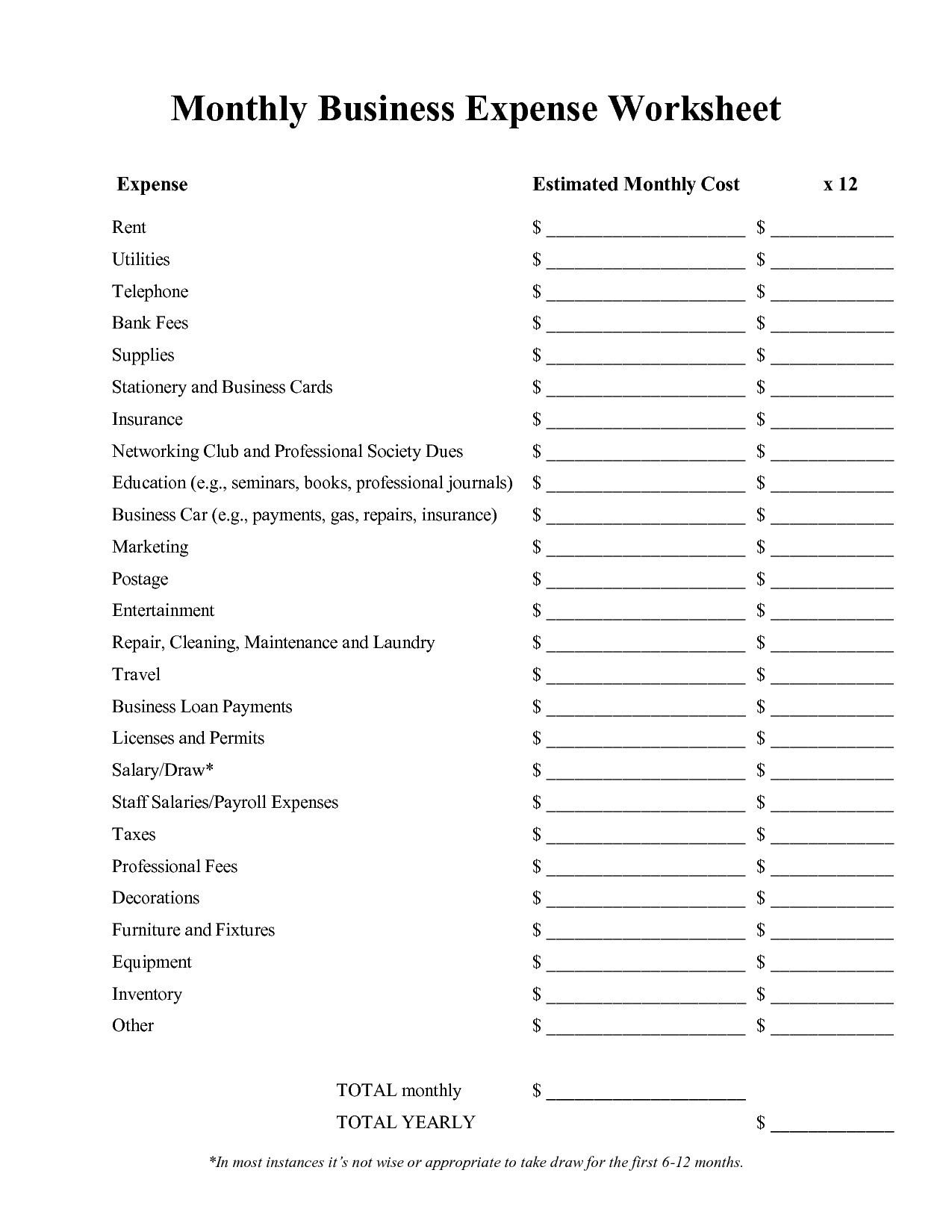

As a self-employed taxpayer, keeping track of your expenses is crucial for properly filing your taxes. One way to ensure you are deducting all eligible expenses is by using a printable form specifically designed for self-employed individuals. This form can help you organize and categorize your expenses, making it easier to claim deductions and maximize your tax savings.

By utilizing a printable form for expenses, self-employed taxpayers can streamline the process of recording and documenting their business expenses. This can save time and effort when it comes to preparing for tax season and ensure that no deductible expenses are overlooked. With the right form, you can easily track expenses such as office supplies, travel costs, and equipment purchases.

Printable Form For Expenses Self Employed Taxpayers

Printable Form For Expenses Self Employed Taxpayers

When filling out the form, be sure to include all relevant information for each expense, including the date of purchase, amount spent, and the purpose of the expense. Keeping detailed records will not only help you accurately report your expenses but also provide documentation in case of an audit. Additionally, make sure to keep receipts and other supporting documents to substantiate your expenses.

Using a printable form for expenses can also serve as a valuable tool for budgeting and financial planning. By tracking your expenses regularly, you can identify areas where you may be overspending and make adjustments to improve your financial health. This can help you make informed decisions about your business and ensure that you are operating within your means.

In conclusion, self-employed taxpayers can benefit greatly from using a printable form for expenses. This tool can help you stay organized, maximize your deductions, and improve your overall financial management. By taking the time to accurately record and document your expenses, you can ensure that you are in compliance with tax laws and make the most of your tax return. So, don’t overlook the importance of using a printable form for expenses as a self-employed individual.