Managing expenses is a crucial aspect of running a business or keeping track of personal finances. One way to streamline this process is by using a printable expense report form. This form allows individuals to record their expenses in an organized manner, making it easier to track spending, budget effectively, and identify areas where costs can be reduced.

Whether you are a small business owner, freelancer, or simply trying to track your personal expenses, having a printable expense report form can simplify the process and save you time. By using a standardized form, you can ensure that all necessary information is included, making it easier to analyze your spending habits and make informed financial decisions.

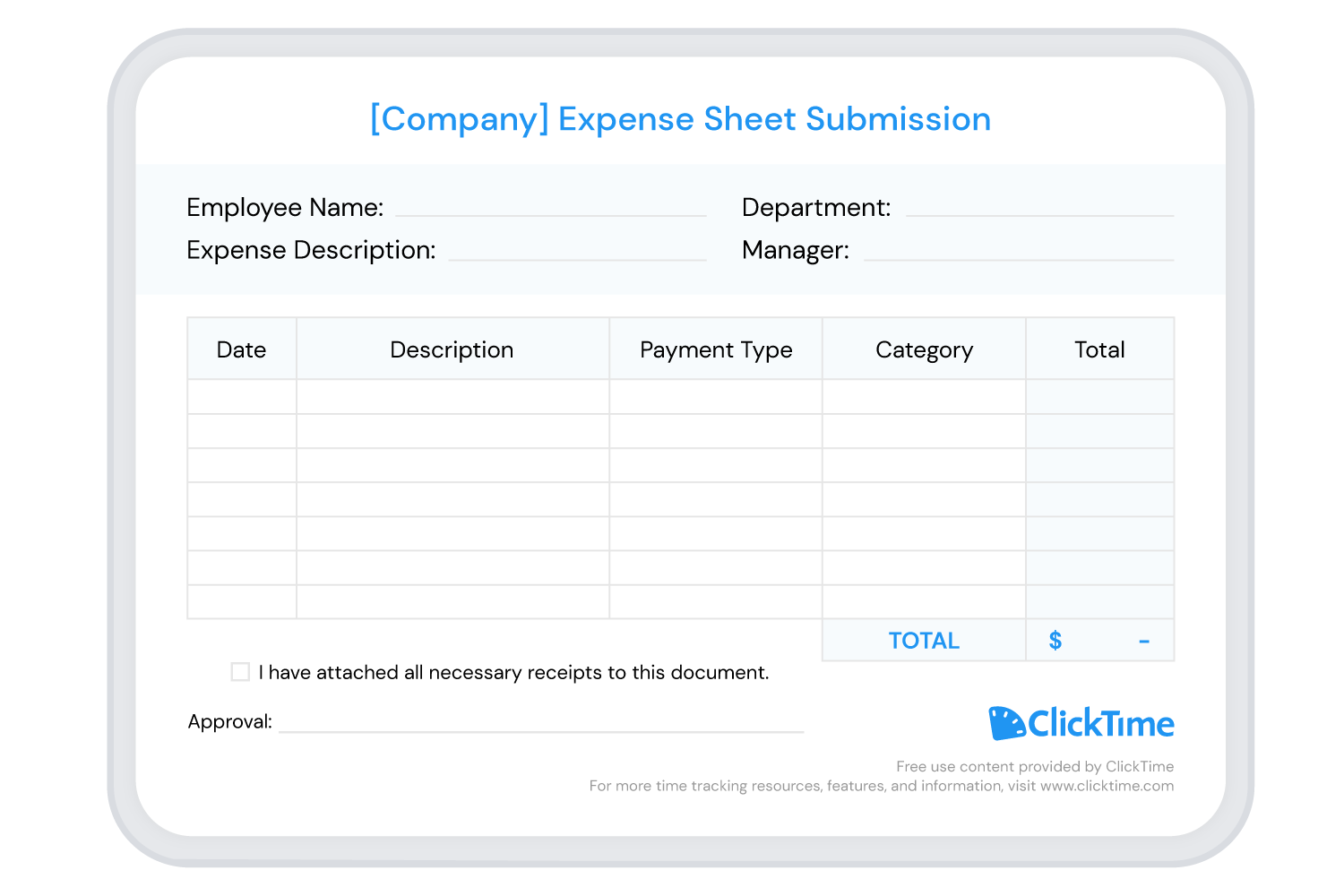

Printable expense report forms typically include fields for recording the date of the expense, the amount spent, a description of the expense, and the category it falls under (such as travel, supplies, or utilities). Some forms may also include fields for noting the payment method used and attaching receipts for documentation purposes.

By using a printable expense report form, you can easily track your spending over a specific period, such as a week, month, or quarter. This can help you identify patterns in your expenses, pinpoint areas where costs are higher than expected, and make adjustments to your budget accordingly. Additionally, keeping detailed records of your expenses can be helpful for tax purposes or when preparing financial reports for your business.

Overall, utilizing a printable expense report form can help you stay organized, save time, and gain valuable insights into your spending habits. Whether you prefer a digital form that can be filled out on your computer or a paper form that can be printed and filled out by hand, having a standardized template can make the process of tracking expenses much more efficient and effective.

Take advantage of the convenience and simplicity of a printable expense report form to take control of your finances and make informed decisions about your spending. By implementing this tool into your financial routine, you can better manage your expenses, track your budget, and work towards your financial goals.