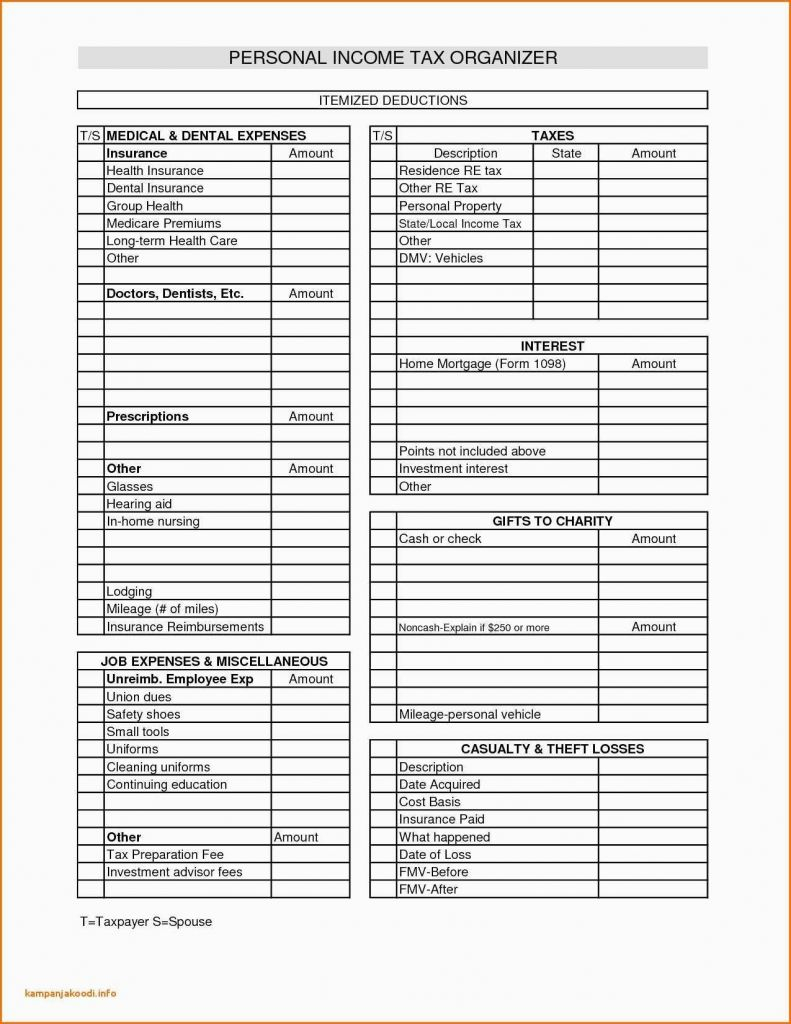

When it comes to tax season, keeping track of your expenses is crucial for maximizing your deductions. One way to ensure you are claiming all the deductions you are eligible for is by using a printable expense report. This report allows you to itemize your expenses and provides a clear breakdown of where your money has been spent throughout the year.

By utilizing a printable expense report for itemized deductions in 2019, you can easily organize your expenses into categories such as medical expenses, charitable contributions, and business expenses. This will help you identify areas where you may be able to claim deductions and ultimately reduce your taxable income.

Printable Expense Report For Itemized Deductions 2019

Printable Expense Report For Itemized Deductions 2019

One of the key benefits of using a printable expense report is that it provides a tangible record of your expenses that can be easily referenced when filing your taxes. By having all of your expenses neatly documented, you can confidently claim deductions without the fear of missing out on potential savings.

Furthermore, a printable expense report can also help you stay organized throughout the year by keeping all of your receipts and records in one place. This can save you time and stress when it comes time to file your taxes, as you will already have all of the necessary information at your fingertips.

Overall, using a printable expense report for itemized deductions in 2019 is a smart way to track your expenses, maximize your deductions, and stay organized throughout the year. By taking the time to document your expenses, you can potentially save yourself money and hassle when it comes time to file your taxes.

Make sure to utilize a printable expense report for itemized deductions in 2019 to take full advantage of all the deductions you are entitled to. By staying organized and keeping track of your expenses, you can set yourself up for a successful tax season and potentially save yourself money in the process.