In today’s fast-paced business world, keeping track of expenses is crucial for the success of any company. Monitoring and analyzing expenses can help businesses make informed decisions, cut costs, and maximize profits. One of the most efficient ways to document and manage business expenses is through a printable business expense report.

A printable business expense report is a valuable tool that allows employees to record all their business-related expenses in an organized manner. It helps streamline the reimbursement process and provides a clear overview of where the company’s money is being spent. With a printable expense report, businesses can easily track expenses, identify trends, and make necessary adjustments to their budget.

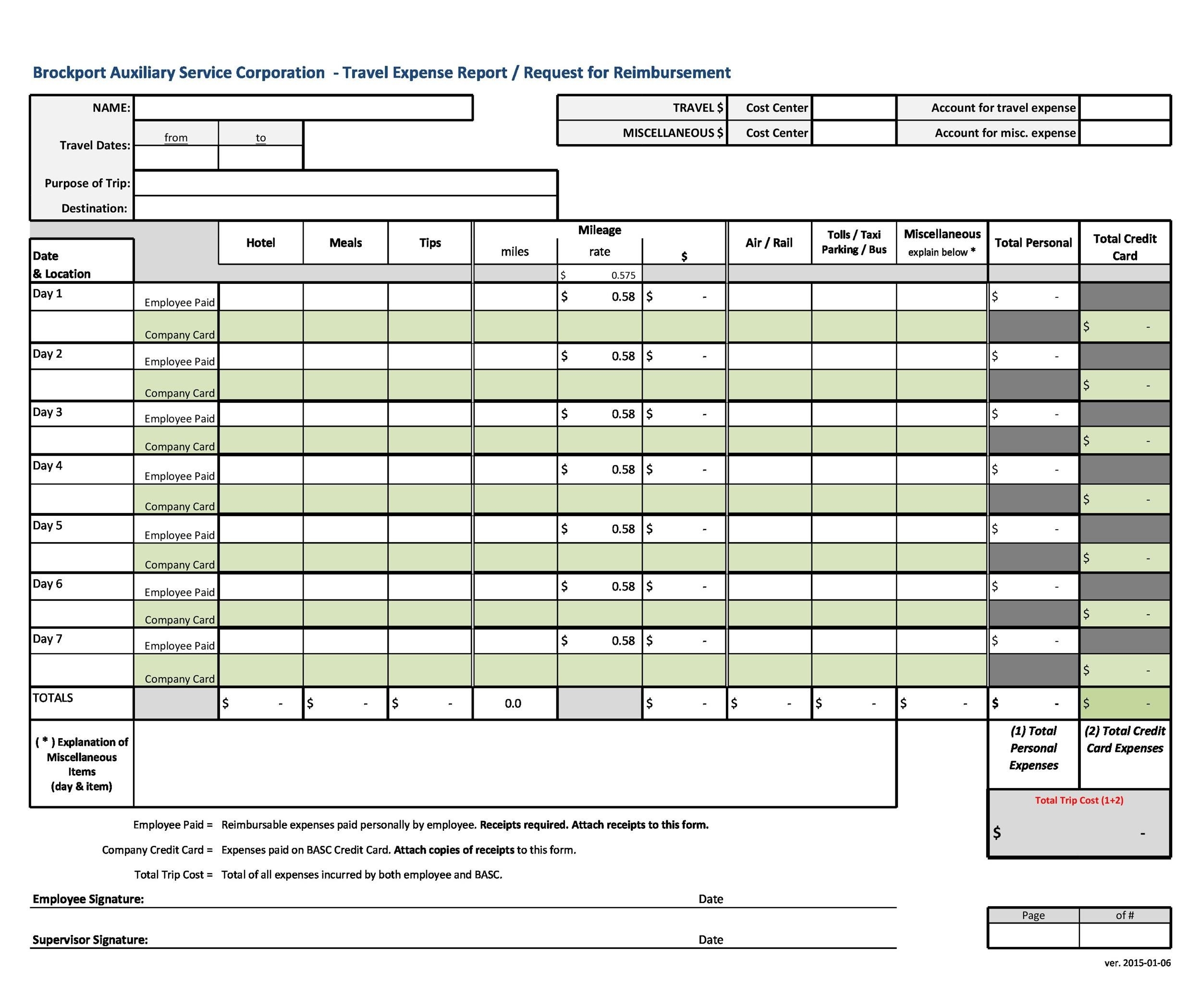

Printable Business Expense Report

Printable Business Expense Report

Using a printable business expense report can also help businesses maintain accurate financial records for tax purposes. By keeping detailed records of all business expenses, companies can ensure compliance with tax laws and regulations. Additionally, having a well-documented expense report can help businesses avoid potential audits and penalties.

Printable business expense reports come in various formats, such as Excel spreadsheets, PDF files, or online templates. These reports typically include fields for date, description of expense, amount, category, and any supporting documentation. Employees can fill out the report for each expense they incur, and then submit it to their manager or accounting department for approval and reimbursement.

Overall, a printable business expense report is a simple yet effective tool for businesses to track and manage their expenses. By implementing a standardized reporting system, companies can improve financial transparency, reduce errors, and optimize their budgeting process. With accurate and up-to-date expense reports, businesses can make informed decisions that contribute to their long-term success.

In conclusion, utilizing a printable business expense report is essential for any company looking to maintain financial health and accountability. By implementing a structured reporting system, businesses can streamline their expense tracking process, improve financial transparency, and make informed decisions based on accurate data. With the right tools and processes in place, businesses can effectively manage their expenses and drive profitability.