Managing personal finances can be a daunting task, but with the help of a personal budget Excel template, it can become much easier. By using this tool, individuals can track their income, expenses, and savings in an organized manner, allowing them to make more informed financial decisions.

With a personal budget Excel template, users can customize categories based on their specific needs and goals. This allows for a more personalized budgeting experience, as individuals can track expenses such as groceries, transportation, entertainment, and more. By inputting income and expenses into the template, users can easily see where their money is going and make adjustments as needed.

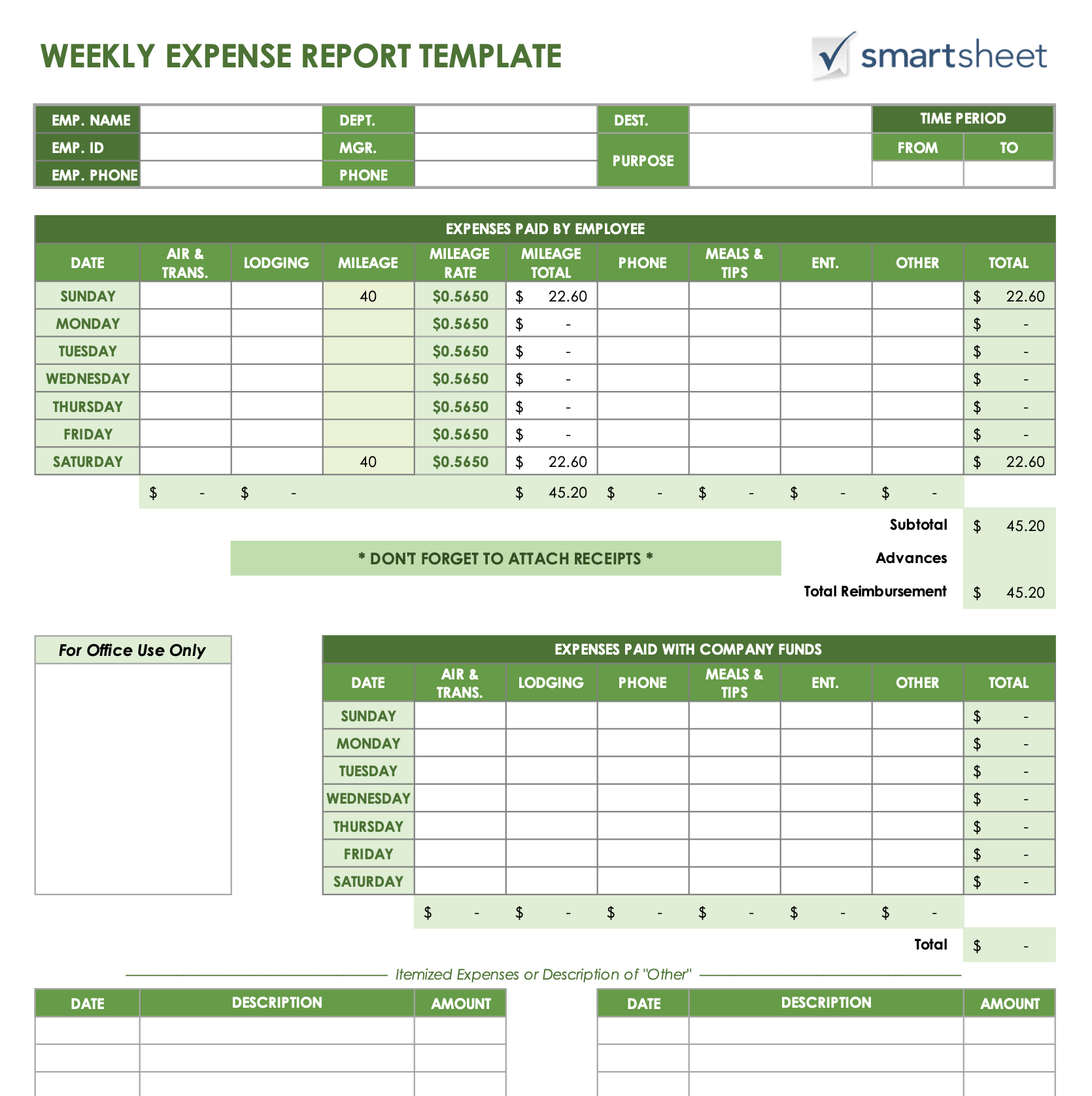

Personal Budget Excel Template

Personal Budget Excel Template

Benefits of Using a Personal Budget Excel Template

One of the main benefits of using a personal budget Excel template is that it provides a clear overview of one’s financial situation. By organizing income and expenses into categories, users can see exactly how much they are spending in each area and identify areas where they can cut back. This can help individuals save money, pay off debt, and reach their financial goals more efficiently.

Another advantage of using a personal budget Excel template is the ability to track progress over time. By inputting data consistently, users can compare month-to-month or year-to-year to see how their financial situation is improving. This can provide motivation to stick to a budget and make positive financial choices.

Additionally, a personal budget Excel template can help individuals plan for future expenses and save for long-term goals. By setting aside money each month for things like emergencies, vacations, or retirement, users can ensure they are financially prepared for whatever comes their way. This can provide peace of mind and reduce financial stress.

In conclusion, a personal budget Excel template is a valuable tool for managing personal finances effectively. By customizing categories, tracking income and expenses, and monitoring progress over time, individuals can take control of their financial future and reach their goals more efficiently. With the help of this tool, budgeting can become a manageable and even empowering experience.