Managing payroll can be a daunting task for any business owner. Keeping track of employee wages, taxes, and deductions can quickly become overwhelming without the right tools in place. This is where a paycheck stub template in Excel can be a game-changer. By using a pre-designed template, you can streamline the process of creating accurate and professional-looking pay stubs for your employees.

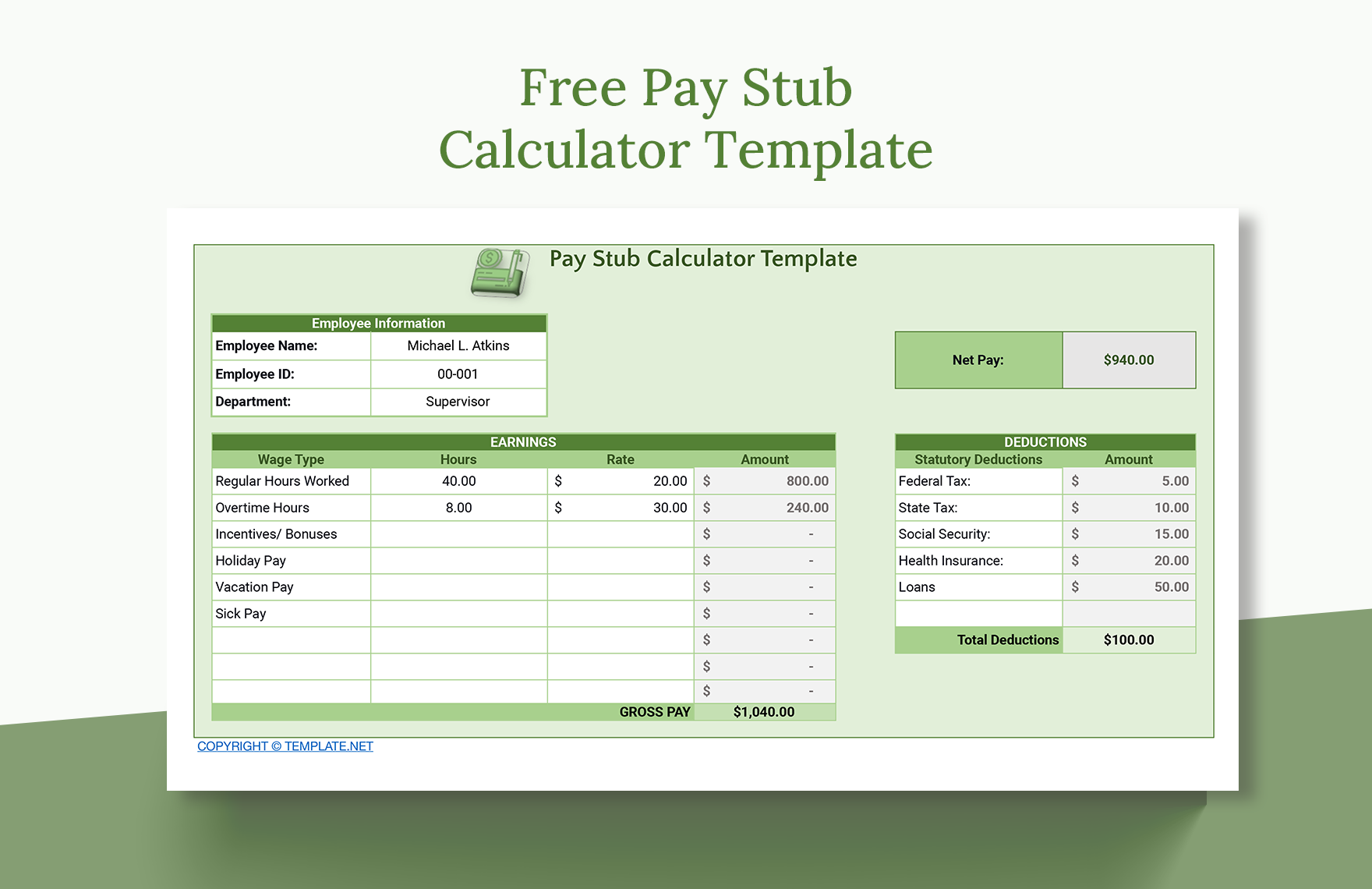

One of the main benefits of using a paycheck stub template in Excel is the ability to easily customize it to fit your specific needs. Whether you have hourly or salaried employees, the template can be tailored to include the necessary information such as gross pay, deductions, and net pay. This not only saves time but also ensures that each pay stub is consistent and error-free.

Furthermore, Excel’s built-in formulas and functions make calculating wages and deductions a breeze. You can simply input the necessary data, and the template will automatically calculate the totals for you. This eliminates the risk of human error and ensures that each pay stub is accurate.

Another advantage of using a paycheck stub template in Excel is the professional appearance it provides. A well-designed pay stub can instill confidence in your employees and demonstrate your commitment to transparency and accuracy in payroll management. This can help build trust and foster a positive relationship between you and your employees.

Additionally, by using a template, you can easily keep track of payroll records and generate reports as needed. This can be especially helpful during tax season or in the event of an audit. Having organized and detailed pay stubs on hand can save you time and stress when it comes to reporting wages and deductions to the appropriate authorities.

In conclusion, utilizing a paycheck stub template in Excel can greatly simplify the payroll process for any business. From customization and accuracy to professionalism and record-keeping, the benefits of using a template are numerous. By taking advantage of this tool, you can streamline your payroll operations and ensure that your employees are paid accurately and on time.