Managing your monthly income and expenses is crucial for maintaining financial stability. One effective way to track your finances is by using a Monthly Income and Expense Printable Worksheet. This tool helps you monitor your income sources and where your money is going, allowing you to make informed decisions about your spending habits.

Every Dollar is a popular budgeting tool that offers a user-friendly Monthly Income and Expense Printable Worksheet. With this worksheet, you can easily input your income and expenses, categorize them, and calculate your total monthly budget. It helps you visualize your financial situation and identify areas where you can cut back or save more.

Monthly Income And Expense Printable Worksheet Every Dollar

Monthly Income And Expense Printable Worksheet Every Dollar

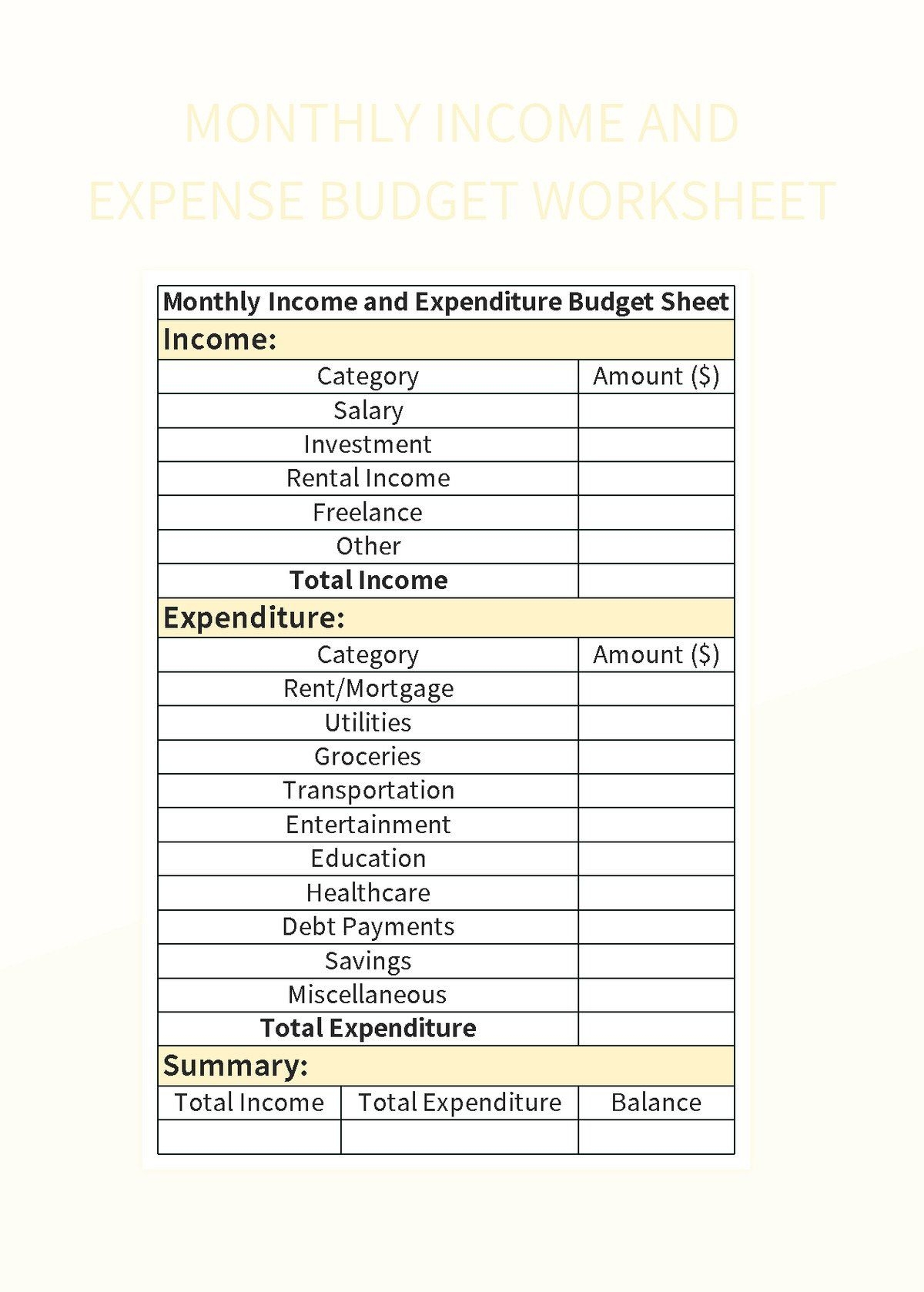

When using the Every Dollar Monthly Income and Expense Printable Worksheet, start by listing all your sources of income for the month. This may include your salary, freelance earnings, rental income, or any other money coming in. Once you have your total income calculated, move on to listing your expenses.

Categorize your expenses into fixed costs (such as rent, utilities, and insurance) and variable costs (like groceries, entertainment, and shopping). Assign each expense to its respective category on the worksheet and input the amounts. The worksheet will automatically calculate your total expenses and show you whether you are spending more than you earn.

Reviewing your Monthly Income and Expense Printable Worksheet regularly can help you stay on track with your budgeting goals. You can identify areas where you are overspending and make adjustments to ensure you are living within your means. By tracking your finances consistently, you can work towards achieving financial stability and peace of mind.

In conclusion, utilizing a Monthly Income and Expense Printable Worksheet like Every Dollar can significantly improve your financial management skills. By accurately tracking your income and expenses, you can make informed decisions about your spending habits and work towards achieving your financial goals. Take control of your finances today with this helpful tool!