When it comes to managing loans, having a loan amortization table can be incredibly helpful. This table allows you to see a breakdown of your loan payments over time, including how much of each payment goes towards the principal and how much goes towards interest. By using an Excel template to create your loan amortization table, you can easily track your loan progress and make informed financial decisions.

Creating a loan amortization table in Excel can seem daunting, but with the right template, it becomes much simpler. With just a few inputs, such as the loan amount, interest rate, and loan term, you can generate a detailed table that shows each monthly payment and how it contributes to paying off your loan.

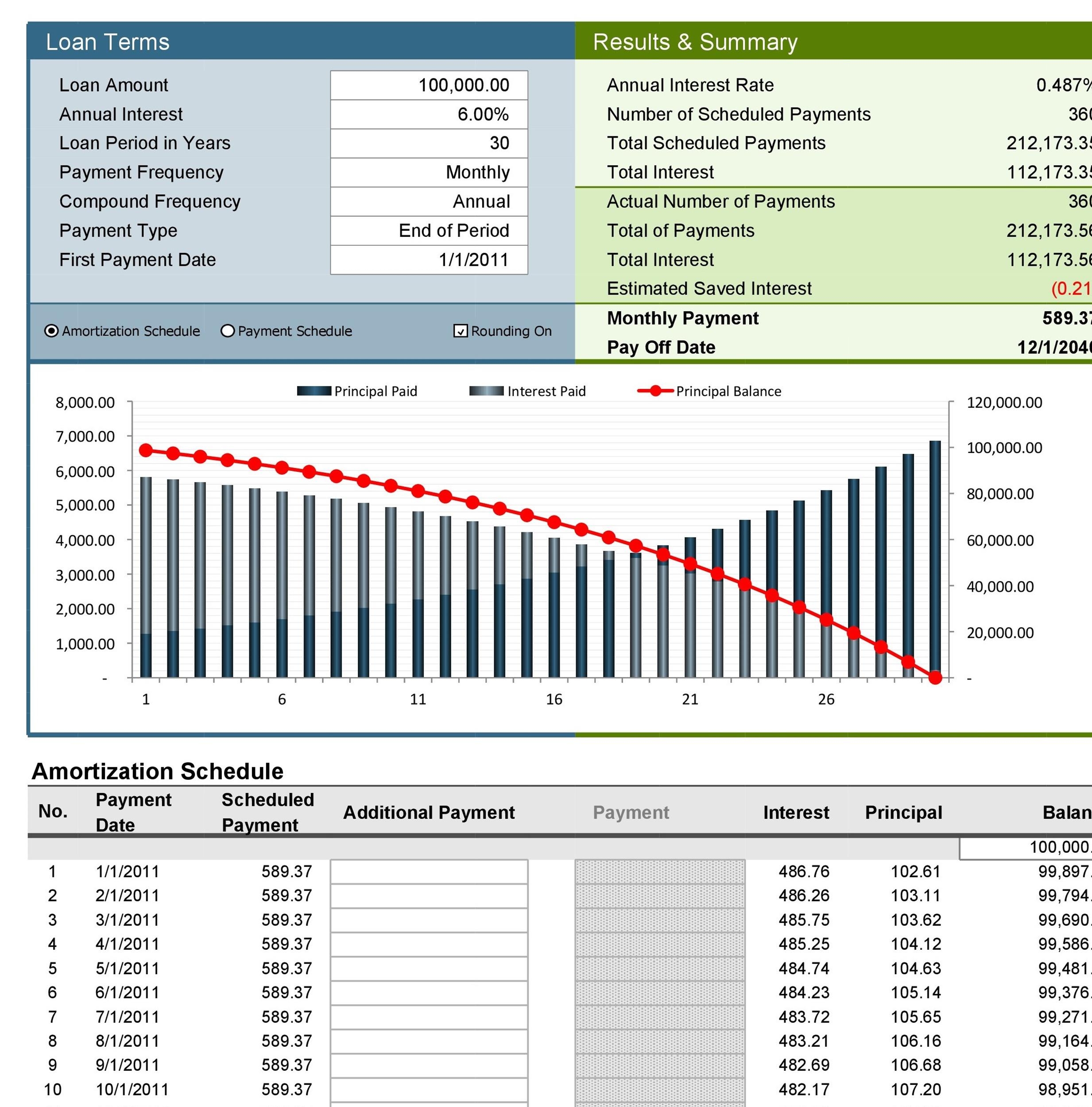

Loan Amortization Table Excel Template

Loan Amortization Table Excel Template

One of the key benefits of using an Excel template for your loan amortization table is the ability to customize it to fit your specific needs. You can easily adjust the table to account for extra payments, changes in interest rates, or any other factors that may impact your loan repayment schedule. This flexibility allows you to stay on top of your loan payments and make adjustments as needed.

Another advantage of using an Excel template for your loan amortization table is the ability to easily visualize your loan repayment progress. The table can show you how much of the loan you have paid off each month, as well as how much you still owe. This visual representation can help you stay motivated and track your financial goals.

In conclusion, a loan amortization table Excel template is a valuable tool for managing your loans effectively. By using a template, you can create a detailed repayment schedule that allows you to track your progress, make informed decisions, and stay on top of your financial commitments. With the flexibility and customization options that Excel provides, you can tailor your table to fit your unique financial situation and achieve your loan repayment goals.