Keeping track of your home expenses and budget can be a daunting task, but with the help of housing excel templates, it can become much easier and more organized. These templates are designed to help you manage your finances and keep track of your home-related expenses in a structured and efficient manner.

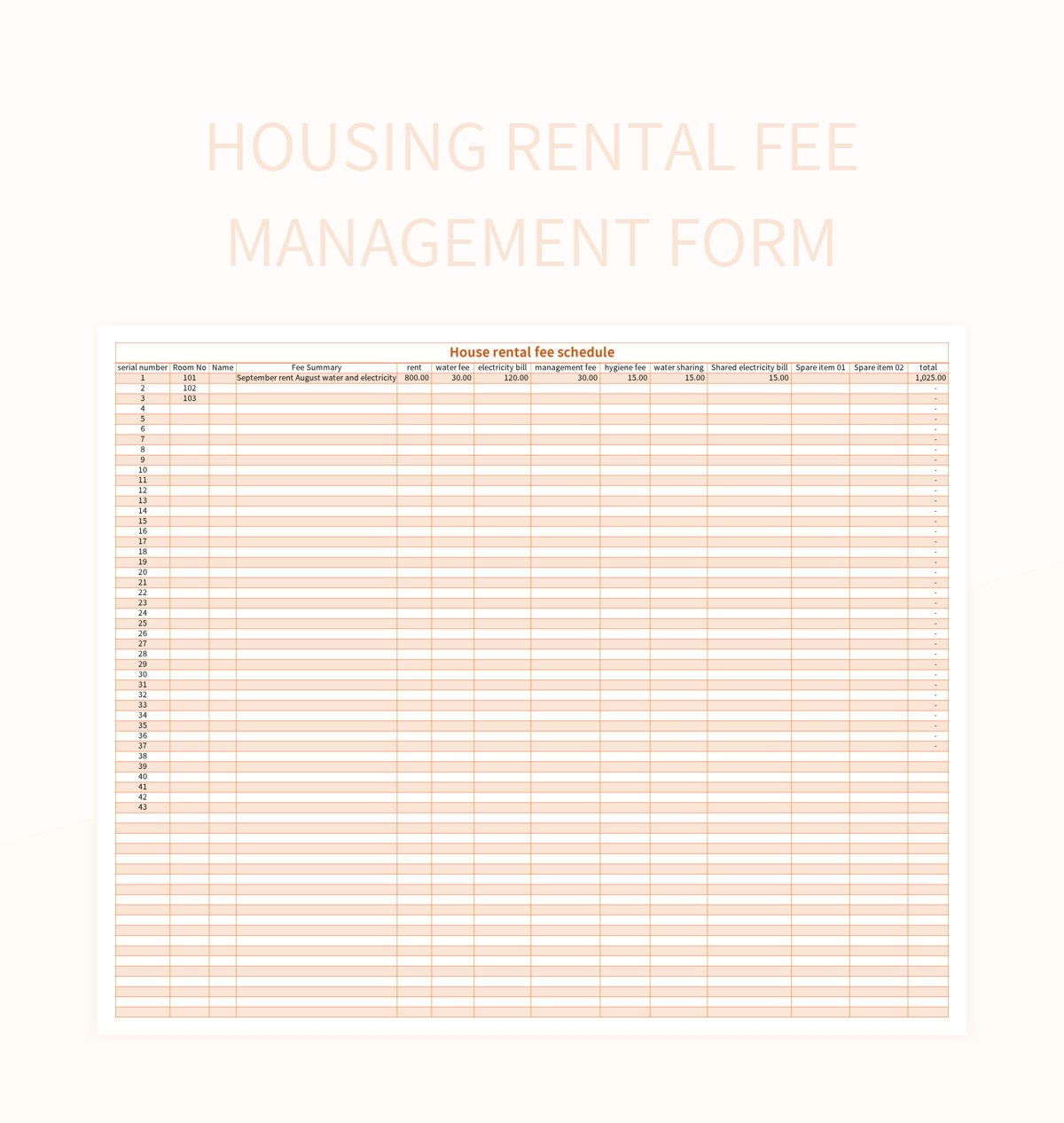

One of the main benefits of using housing excel templates is that they allow you to input all your expenses and income in one place, making it easier to track your budget and identify any areas where you may be overspending. These templates come with pre-designed categories for common home expenses such as mortgage or rent, utilities, groceries, and maintenance costs, making it simple to input your data and analyze your spending patterns.

Another advantage of housing excel templates is that they can help you plan for future expenses and set financial goals for your home. By inputting your monthly income and expenses, these templates can calculate your net income and show you how much you can save or allocate towards specific goals such as home renovations or a down payment for a new property.

Furthermore, housing excel templates can also help you track your home equity and net worth over time. By inputting the value of your home and any outstanding mortgage debt, these templates can calculate your home equity and show you how it changes as you make mortgage payments or if your home’s value appreciates. This can be a useful tool for monitoring your financial progress and making informed decisions about your home ownership.

In conclusion, housing excel templates are essential tools for organizing your home finances and budget. Whether you are a homeowner, renter, or looking to buy a new property, these templates can help you stay on top of your expenses, set financial goals, and track your home equity over time. By utilizing these templates, you can take control of your finances and make informed decisions about your housing needs.