Managing expenses is crucial for any small business to stay on track financially. One way to do this is by using a monthly expense sheet to track all the money going in and out of your business. Keeping a detailed record of your expenses can help you identify areas where you can cut costs and improve your overall financial health.

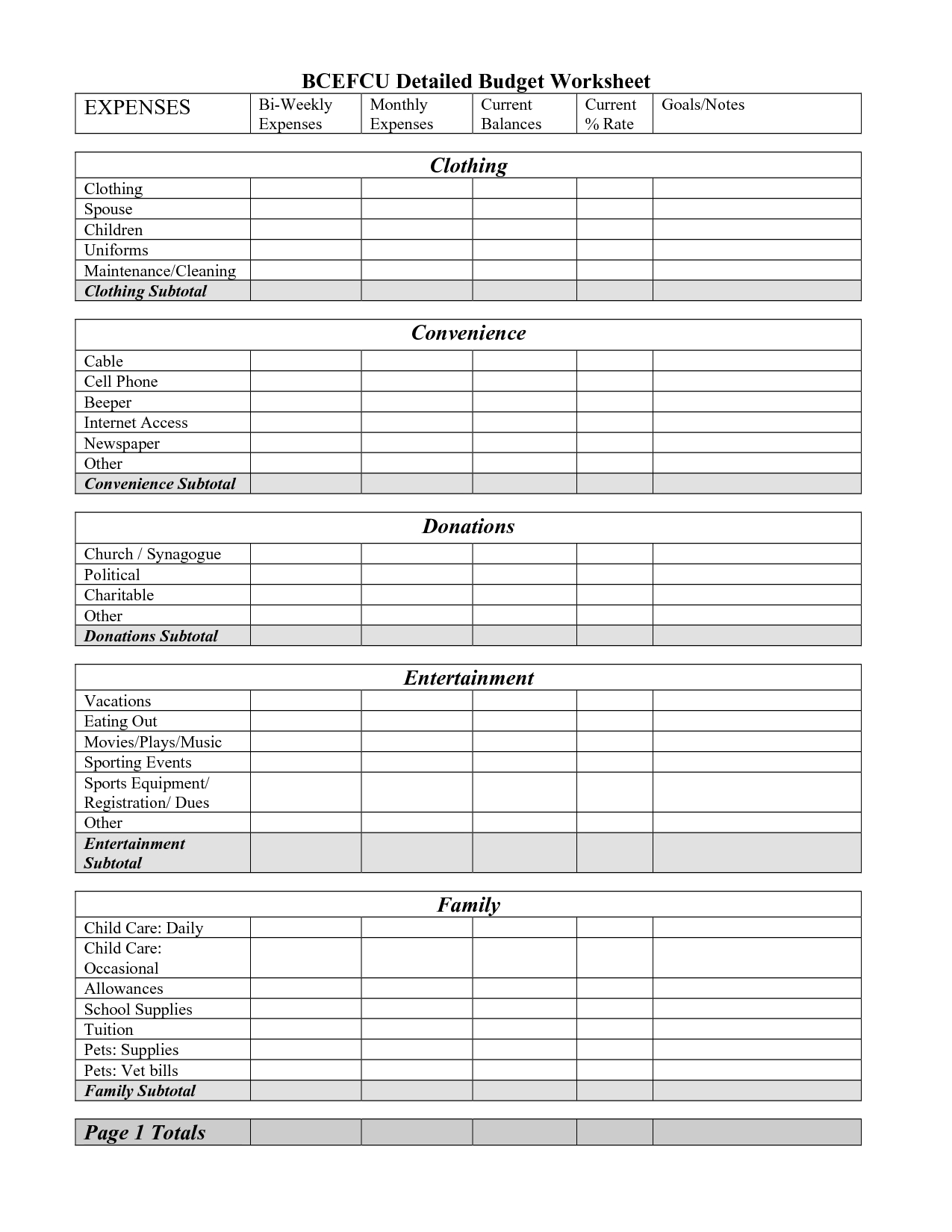

Creating a monthly expense sheet doesn’t have to be complicated or time-consuming. In fact, there are many free printable templates available online that you can use to get started. These templates typically include categories for different types of expenses, such as rent, utilities, supplies, and payroll. By filling in the amounts spent in each category, you can easily see where your money is going each month.

Free Printable Monthly Expense Sheet For Small Business

Free Printable Monthly Expense Sheet For Small Business

Using a monthly expense sheet can also help you track your spending patterns over time. By comparing your expenses from month to month, you can identify any trends or inconsistencies that may need further investigation. This can be especially helpful when it comes time to create a budget for your business, as you’ll have a clear picture of where your money is going and where you may need to make adjustments.

Another benefit of using a monthly expense sheet is that it can help you prepare for tax season. By keeping detailed records of all your business expenses throughout the year, you’ll have all the information you need to accurately report your deductions and maximize your tax savings. This can also help you avoid any potential issues with the IRS by providing clear documentation of your business expenses.

In conclusion, a free printable monthly expense sheet is a valuable tool for any small business looking to improve their financial management. By tracking your expenses on a regular basis, you can gain better insight into your spending habits, identify areas for improvement, and prepare for tax season more effectively. With the help of a simple template, you can easily create and maintain a monthly expense sheet that will keep your business on track financially.