In today’s fast-paced world, managing your finances can be a challenging task. Keeping track of your income and expenses is essential to ensure financial stability and plan for the future. One way to stay organized and on top of your finances is by using income and expense forms. These forms provide a structured way to document your earnings, spending, and savings, helping you make informed financial decisions.

Free printable income expense forms are a convenient and cost-effective tool for individuals and businesses to monitor their financial activities. Whether you are a freelancer, small business owner, or simply looking to budget your personal finances, these forms can help you track where your money is coming from and where it is going.

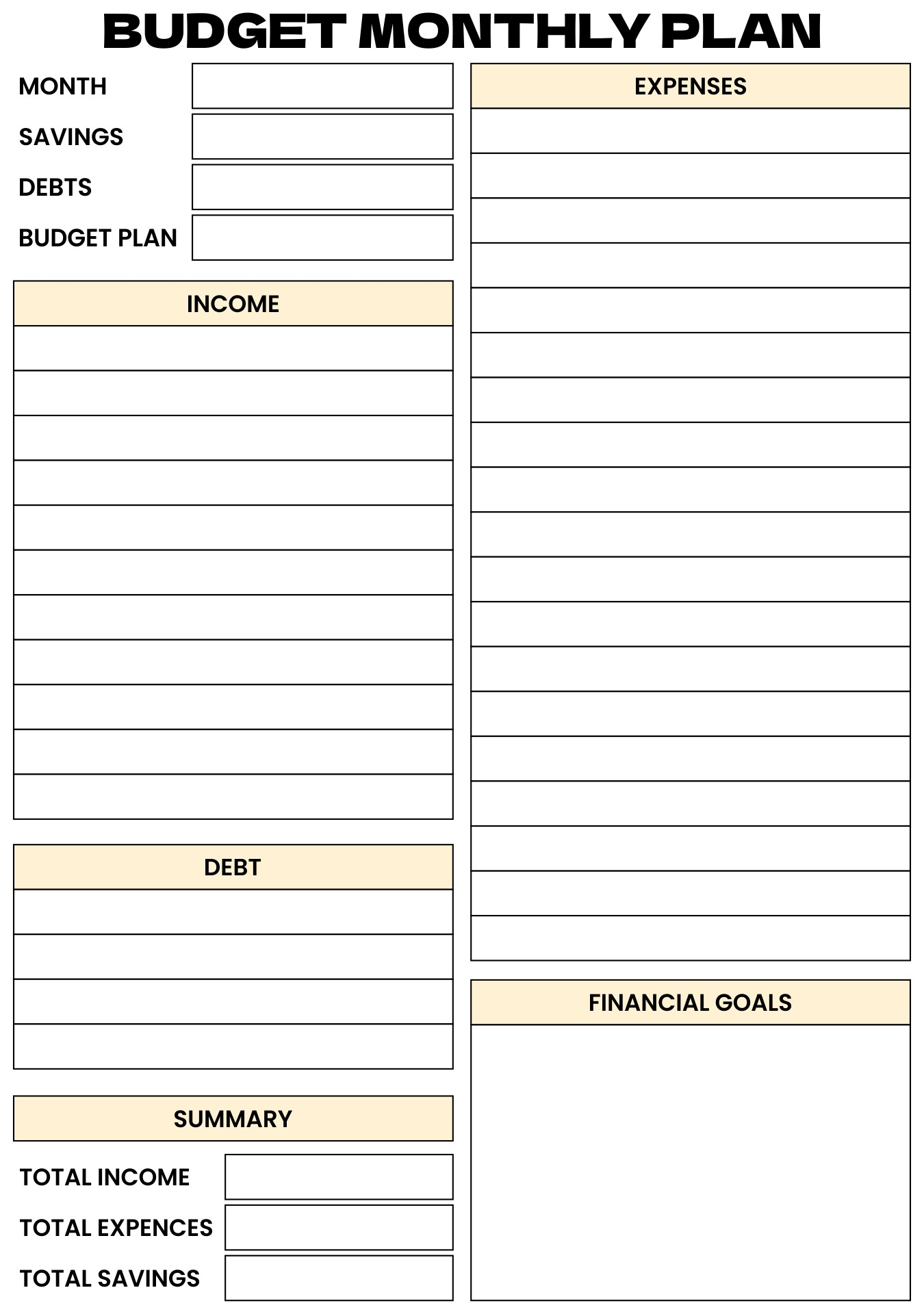

Free Printable Income Expense Forms

Free Printable Income Expense Forms

These forms typically include sections to input your sources of income, such as wages, rental income, or investment returns, as well as categories for various expenses, such as housing, transportation, groceries, and entertainment. By filling out these forms regularly, you can identify areas where you may be overspending or opportunities to increase your savings.

Furthermore, using income and expense forms can help you set financial goals and track your progress towards achieving them. Whether you are saving for a vacation, a new car, or retirement, having a clear picture of your financial situation can motivate you to make smarter spending decisions and increase your savings rate.

With the availability of free printable income expense forms online, you can easily download and print these templates to start organizing your finances today. There are various designs and formats to choose from, depending on your preferences and needs. Whether you prefer a simple spreadsheet layout or a more detailed form with charts and graphs, you can find a template that suits your style.

In conclusion, free printable income expense forms are valuable tools for managing your finances effectively. By using these forms to track your income, expenses, and savings, you can gain a better understanding of your financial habits and make informed decisions to improve your financial well-being. Take advantage of these free resources to take control of your finances and work towards achieving your financial goals.