Managing a family budget can be a challenging task, especially when trying to keep track of various expenses and income sources. However, utilizing an Excel template for family budgeting can make this process much simpler and more organized.

Excel templates are pre-designed spreadsheets that can help you track your family’s finances, set financial goals, and monitor your spending habits. These templates are user-friendly and can be customized to fit your specific needs and preferences.

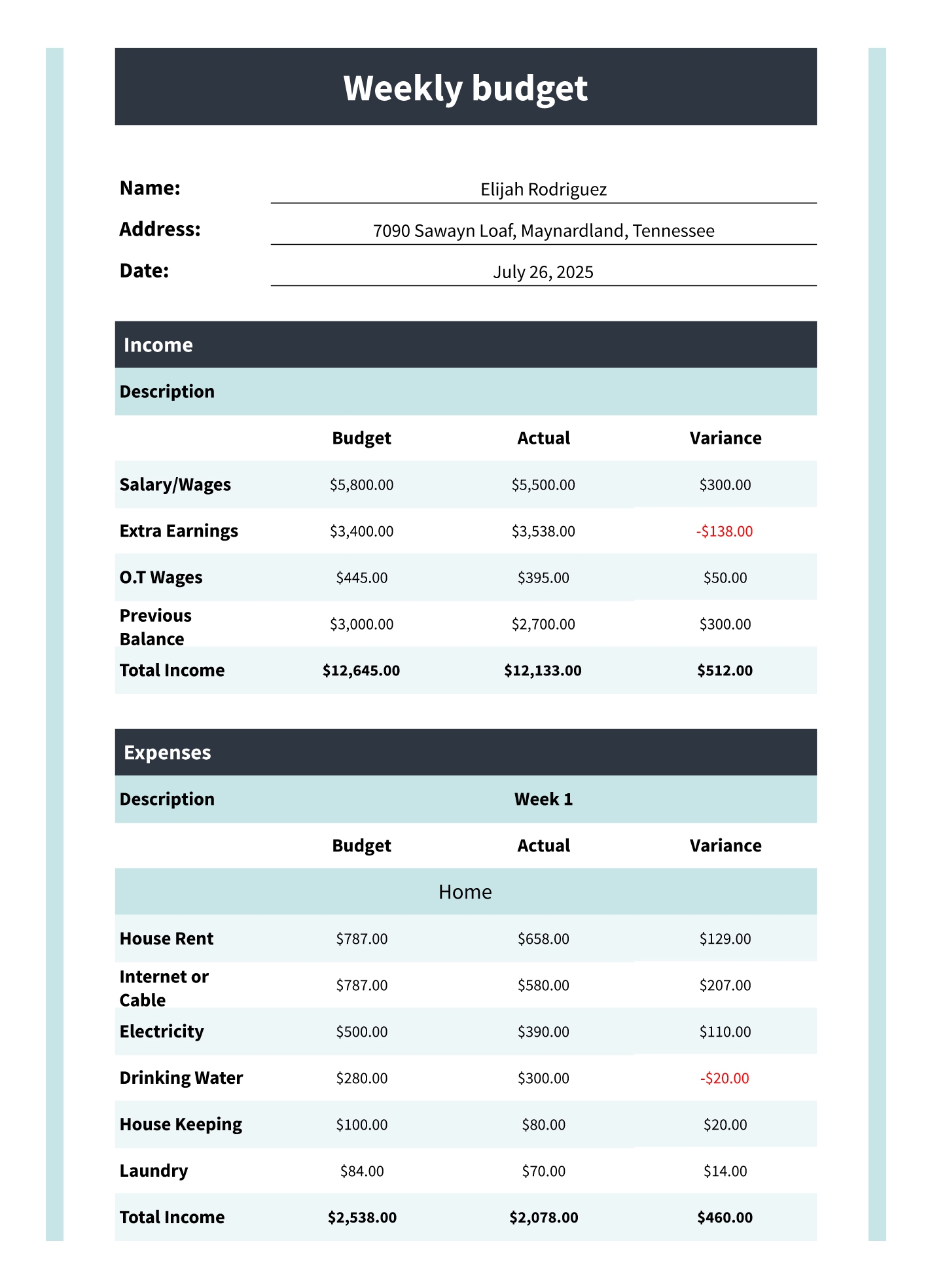

Excel Template For Family Budget

Excel Template For Family Budget

One of the key benefits of using an Excel template for family budgeting is that it allows you to see a comprehensive overview of your financial situation. You can easily input your income sources, fixed expenses, variable expenses, savings goals, and debt payments into the spreadsheet, which will then automatically calculate your total income, expenses, and savings.

Additionally, Excel templates often come with built-in formulas and functions that can help you analyze your financial data more effectively. For example, you can use the SUM function to calculate your total expenses for the month, or the IF function to set up conditional formatting based on certain criteria.

Furthermore, using an Excel template for family budgeting can help you identify areas where you may be overspending or where you can cut back on expenses. By tracking your spending habits over time, you can make more informed decisions about where to allocate your money and how to achieve your financial goals.

In conclusion, utilizing an Excel template for family budgeting can be a valuable tool in helping you manage your finances more effectively. Whether you are trying to save for a major purchase, pay off debt, or simply improve your overall financial health, an Excel template can provide you with the structure and organization you need to succeed.