Managing your company’s capitalization table (cap table) is crucial for any business owner or investor. A cap table is a spreadsheet that shows the equity ownership of the company, including the shares issued to founders, investors, and employees. It is essential to have an accurate and up-to-date cap table to make informed decisions about fundraising, equity distribution, and potential exits.

One of the most popular tools for creating and maintaining a cap table is Microsoft Excel. Excel allows you to customize your cap table to fit the specific needs of your business, and it provides a user-friendly interface for updating and tracking changes over time.

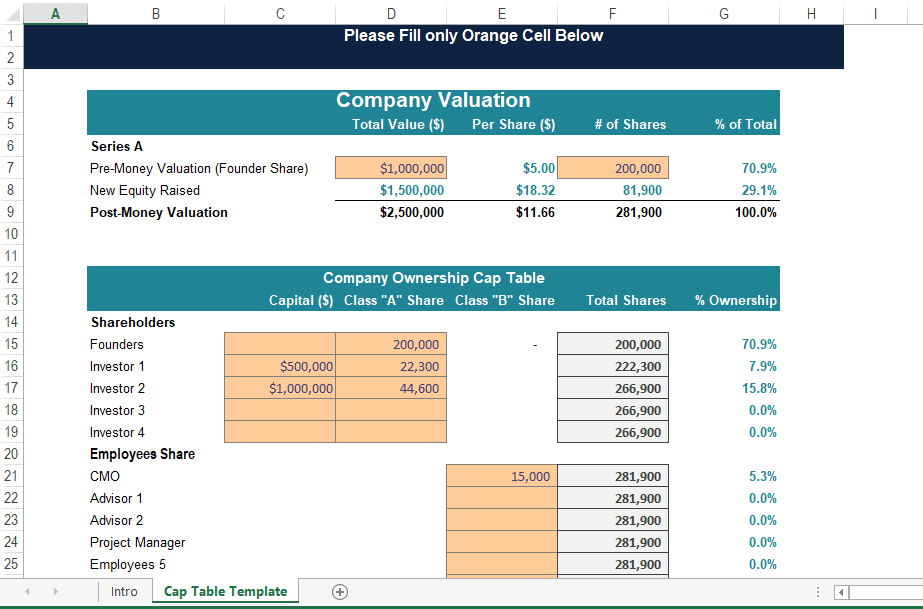

Using a cap table template in Excel can save you time and effort in managing your equity ownership. There are many free and paid templates available online that you can download and use to create your cap table. These templates typically include sections for listing shareholders, their ownership percentages, share classes, and any convertible securities.

With an Excel cap table template, you can easily input new equity issuances, update ownership percentages, and track dilution from future fundraising rounds. The template can also generate helpful reports and visualizations to analyze your company’s ownership structure and make strategic decisions about future funding and equity distribution.

It’s important to regularly update your cap table in Excel to ensure accuracy and transparency for all stakeholders. By using a template, you can streamline the process and keep all relevant information in one centralized location. This will not only save you time but also help you avoid costly mistakes that can arise from inaccurate or outdated cap tables.

In conclusion, a cap table template in Excel is a valuable tool for any business owner or investor looking to manage their company’s equity ownership effectively. By using a template, you can simplify the process of creating and maintaining a cap table, ensuring that you have a clear picture of your company’s ownership structure and can make informed decisions about fundraising and equity distribution.