Creating a budget template in Excel can be a valuable tool for managing your finances effectively. By having a structured budget in place, you can track your expenses, monitor your income, and make informed decisions about your financial goals.

Building a budget template in Excel allows you to customize it to fit your specific needs and preferences. You can input your income sources, expenses, savings goals, and more to get a comprehensive overview of your financial situation.

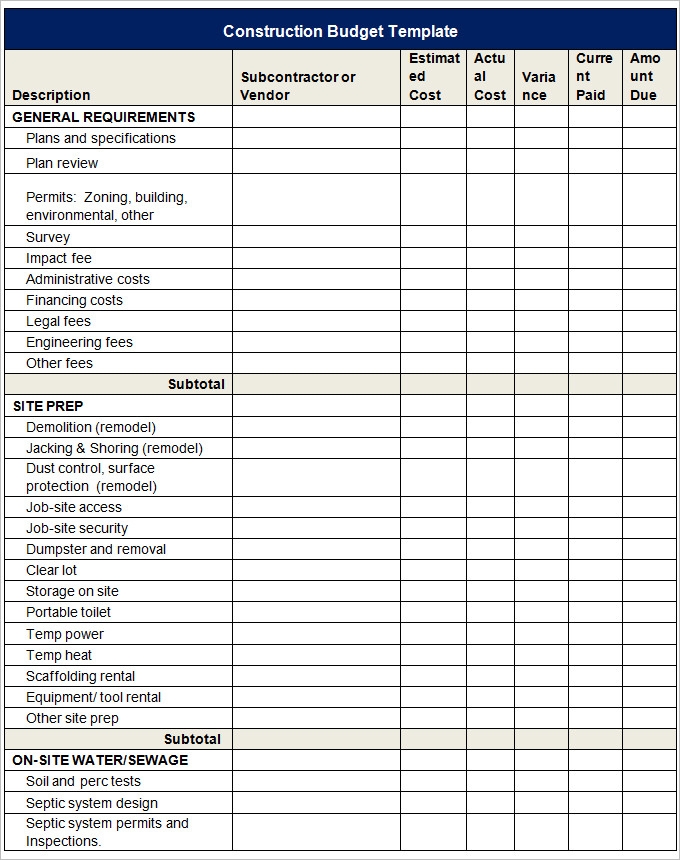

Building Budget Template Excel

Building Budget Template Excel

Start by creating separate columns for different expense categories such as rent, groceries, utilities, transportation, entertainment, and savings. Assign a budgeted amount to each category based on your monthly income and spending habits.

Next, input your actual expenses for each category as you incur them throughout the month. This will allow you to track how closely you are sticking to your budget and identify areas where you may need to cut back or adjust your spending.

Utilize Excel’s built-in formulas and functions to automatically calculate totals, variances, and percentages for each category. This will save you time and ensure accurate calculations in your budget template.

Regularly review and update your budget template to reflect any changes in your financial situation or goals. By keeping your budget up-to-date, you can stay on top of your finances and make adjustments as needed to achieve your financial objectives.

In conclusion, building a budget template in Excel is a practical and effective way to take control of your finances. By organizing your income and expenses in a structured format, you can better manage your money, save for the future, and reach your financial goals.