Creating a budget is essential for managing your finances effectively. It helps you track your expenses, identify areas where you can cut back, and save more money for your financial goals. Budget worksheets with fixed and variable expenses printable can be a useful tool in this process. These worksheets help you categorize your expenses into fixed costs that remain the same each month and variable costs that fluctuate.

By using these worksheets, you can get a clear picture of where your money is going and make informed decisions on how to allocate your funds. This can help you avoid overspending and ensure that you have enough money set aside for important expenses like bills, savings, and emergencies.

Budget Work Sheets With Fixed And Variable Expenses Printable

Budget Work Sheets With Fixed And Variable Expenses Printable

Budget Work Sheets With Fixed And Variable Expenses Printable

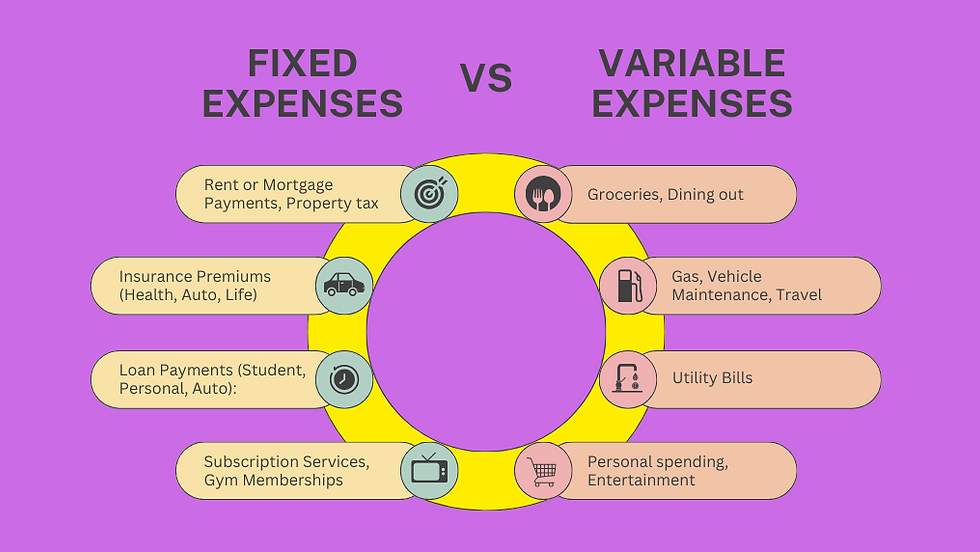

Fixed expenses are costs that remain constant each month, such as rent, mortgage, car payments, and insurance premiums. Variable expenses, on the other hand, are costs that can fluctuate, such as groceries, entertainment, dining out, and shopping. By separating your expenses into these categories, you can better manage your budget and prioritize your spending.

Using a printable budget worksheet with fixed and variable expenses can help you stay organized and keep track of your financial goals. These worksheets typically include sections for you to list your income, fixed expenses, variable expenses, and savings goals. You can also track your actual spending against your budgeted amounts to see where you may need to make adjustments.

By regularly updating and reviewing your budget worksheet, you can identify opportunities to save money, cut back on unnecessary expenses, and increase your savings. This can help you reach your financial goals faster and build a more secure financial future for yourself and your family.

In conclusion, budget worksheets with fixed and variable expenses printable are essential tools for managing your finances effectively. By categorizing your expenses and tracking your spending, you can make informed decisions on how to allocate your funds and reach your financial goals. Whether you’re saving for a big purchase, paying off debt, or building an emergency fund, these worksheets can help you stay on track and achieve financial success.