Managing your finances can be a daunting task, especially when you have bills to pay, groceries to buy, and savings to build. One effective way to stay on top of your finances is by using a bi-weekly budget template in Excel. This tool can help you track your income and expenses, set financial goals, and make informed decisions about your money.

With a bi-weekly budget template in Excel, you can easily input your income sources, such as your salary or any additional sources of income. You can also list your expenses, including bills, groceries, entertainment, and savings goals. By categorizing your expenses, you can see where your money is going and make adjustments as needed.

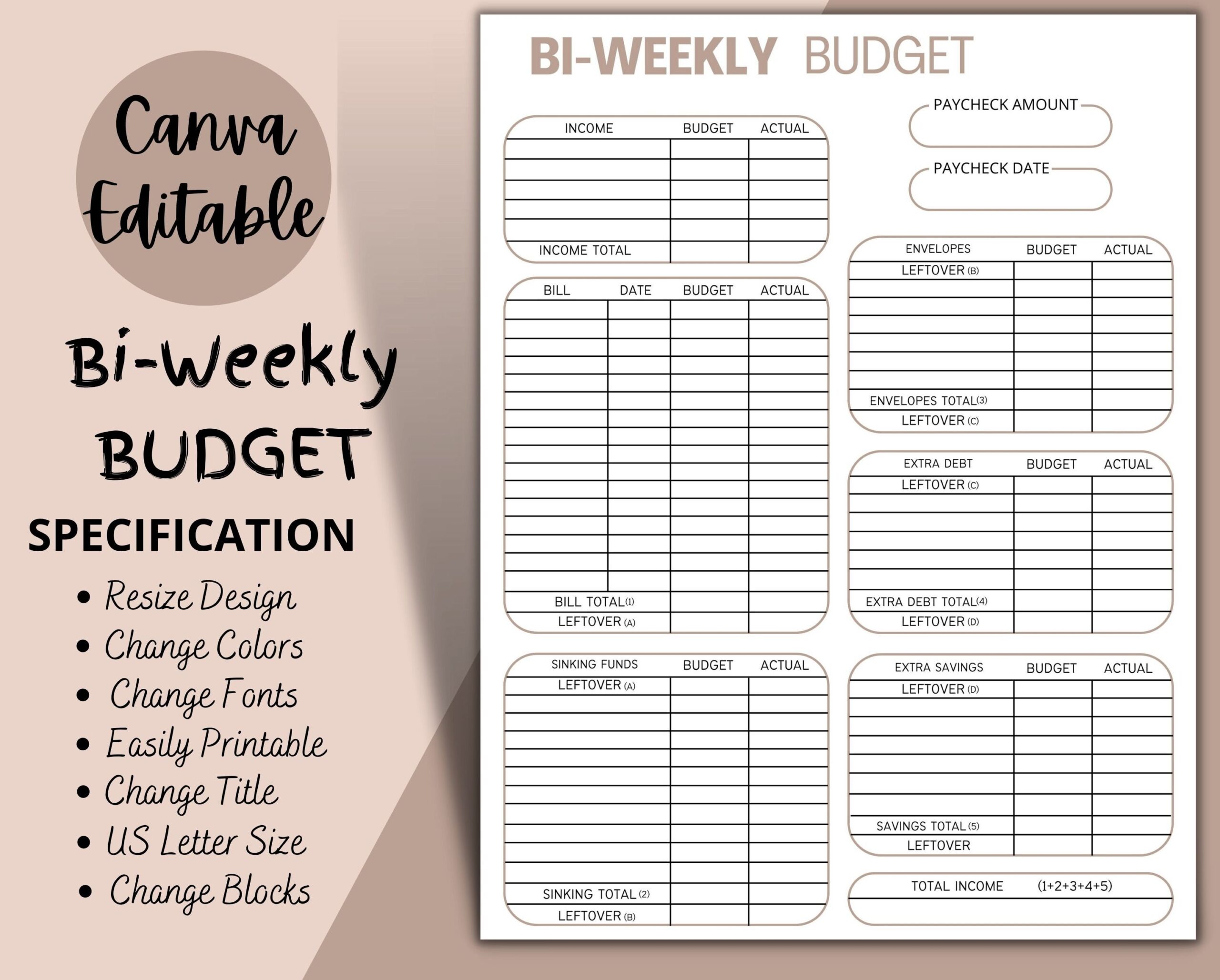

Bi Weekly Budget Template Excel

Bi Weekly Budget Template Excel

One of the advantages of using a bi-weekly budget template in Excel is that it allows you to visualize your financial situation. You can create charts and graphs to see your income versus expenses, track your spending habits over time, and identify areas where you can cut back or save more. This can help you make informed decisions about your money and work towards your financial goals.

Another benefit of using a bi-weekly budget template in Excel is that it can help you stay organized and disciplined with your finances. By regularly updating your budget with your income and expenses, you can stay on top of your financial obligations and avoid overspending. This can help you avoid debt, build up your savings, and achieve financial stability in the long run.

In conclusion, a bi-weekly budget template in Excel can be a valuable tool in helping you manage your finances effectively. By tracking your income and expenses, setting financial goals, and making informed decisions about your money, you can take control of your financial future. So why not give it a try and start using a bi-weekly budget template in Excel today?