In today’s fast-paced business world, it is essential for companies to keep track of their financial transactions accurately. One way to ensure this is by using a bank reconciliation template in Excel. This tool helps businesses compare their internal records with the bank statement to identify any discrepancies and errors.

By using a bank rec template in Excel, companies can easily track and reconcile their bank transactions, identify any missing or duplicate entries, and ensure that their financial records are accurate. This template can save time and effort for businesses, as it automates the reconciliation process and provides a clear overview of the financial status.

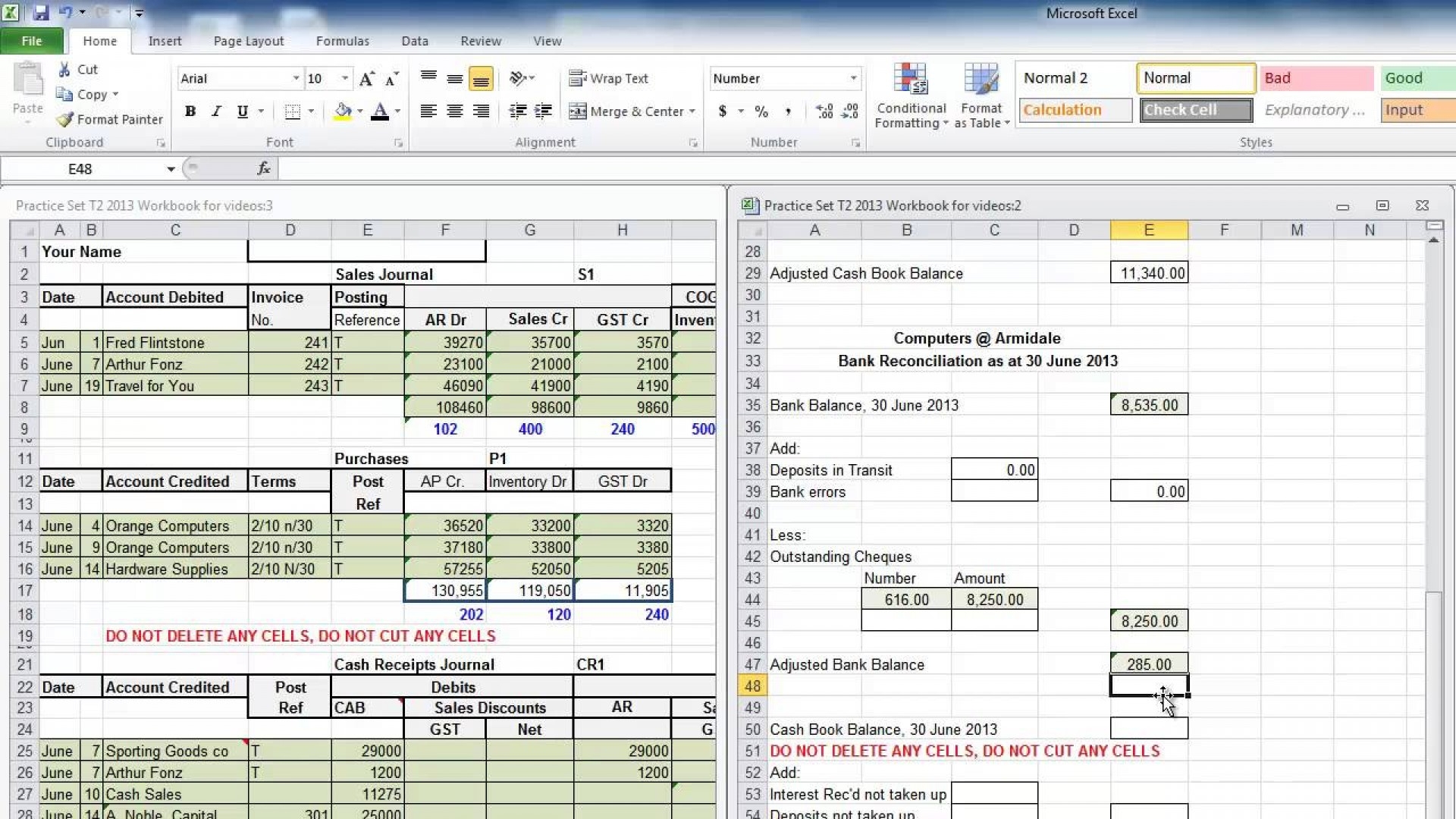

When using a bank rec template in Excel, businesses can input their bank statement data and internal records into the template, which will automatically compare the two sets of data and highlight any discrepancies. This makes it easier for businesses to identify errors and resolve them promptly, ensuring that their financial records are accurate and up-to-date.

Furthermore, the bank rec template in Excel allows businesses to track their outstanding checks, deposits in transit, bank fees, and other transactions easily. This helps companies stay on top of their financial transactions and avoid any potential errors or discrepancies that could impact their financial health.

In conclusion, using a bank rec template in Excel can greatly benefit businesses by streamlining the reconciliation process, ensuring accurate financial records, and helping companies stay on top of their financial transactions. By leveraging this tool, businesses can save time and effort, minimize errors, and maintain a clear overview of their financial status.