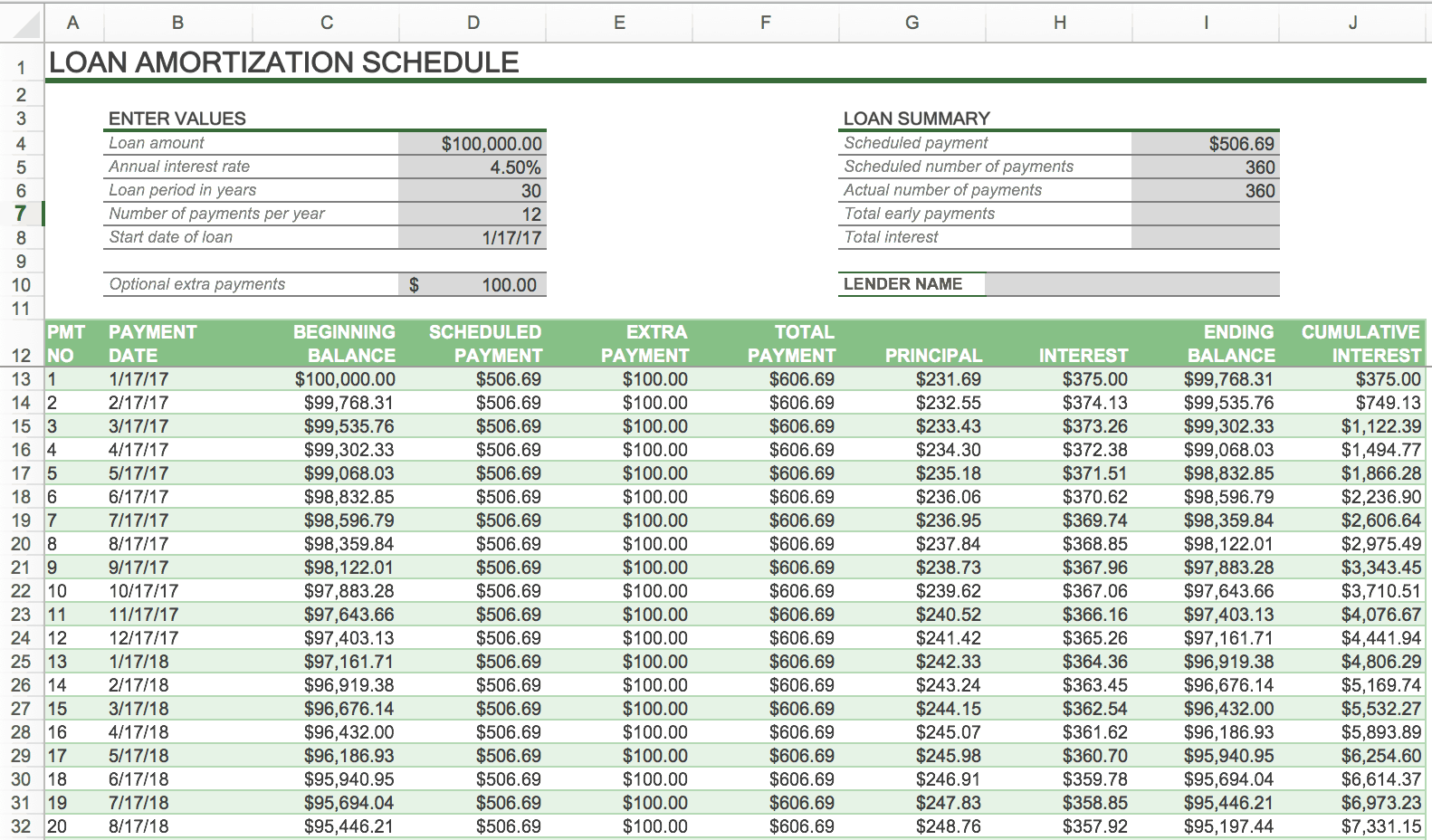

An amortization schedule is a table detailing each periodic payment on an amortizing loan, such as a mortgage or car loan. This schedule shows the amount of each payment that goes towards interest and principal, allowing borrowers to see how their loan balance decreases over time.

Creating an amortization schedule manually can be time-consuming and prone to errors. However, with the help of an Excel template, this process can be automated and simplified, saving you time and ensuring accuracy in your calculations.

Amortization Schedule Excel Template

Amortization Schedule Excel Template

Benefits of Using an Amortization Schedule Excel Template

One of the main benefits of using an Excel template for an amortization schedule is the ease of use. These templates are pre-built with formulas that calculate each payment based on the loan amount, interest rate, and loan term. This eliminates the need for manual calculations and reduces the risk of errors.

Additionally, Excel templates allow you to easily customize your amortization schedule to fit your specific loan terms. You can adjust the loan amount, interest rate, and payment frequency to see how different factors affect your repayment schedule. This flexibility can help you make informed decisions about your loan and budget.

Another advantage of using an Excel template is the ability to track your progress over time. By inputting your actual payments, you can compare them to the scheduled payments to see how much principal you have paid off and how much interest you have saved. This can help you stay on track with your loan repayment goals.

Furthermore, Excel templates provide a visual representation of your loan amortization schedule through graphs and charts. These visual aids can help you better understand how your loan balance decreases over time and how much of each payment goes towards interest and principal. This can be useful for financial planning and decision-making.

In conclusion, using an Excel template for an amortization schedule can streamline the process of tracking your loan repayment and provide valuable insights into your financial situation. Whether you have a mortgage, car loan, or personal loan, utilizing a template can help you stay organized and informed throughout the repayment process.