Managing accounts receivable is crucial for any business to maintain healthy cash flow and ensure timely payments from customers. An effective way to streamline the process is by using an Accounts Receivable Excel Template. This template can help businesses keep track of invoices, payments, and outstanding balances in a structured and organized manner.

By utilizing an Accounts Receivable Excel Template, businesses can easily generate invoices, track payment due dates, and monitor customer payment history. This can help in identifying any overdue payments and following up with customers to ensure timely collections. Additionally, the template can provide insights into the overall financial health of the business and help in making informed decisions.

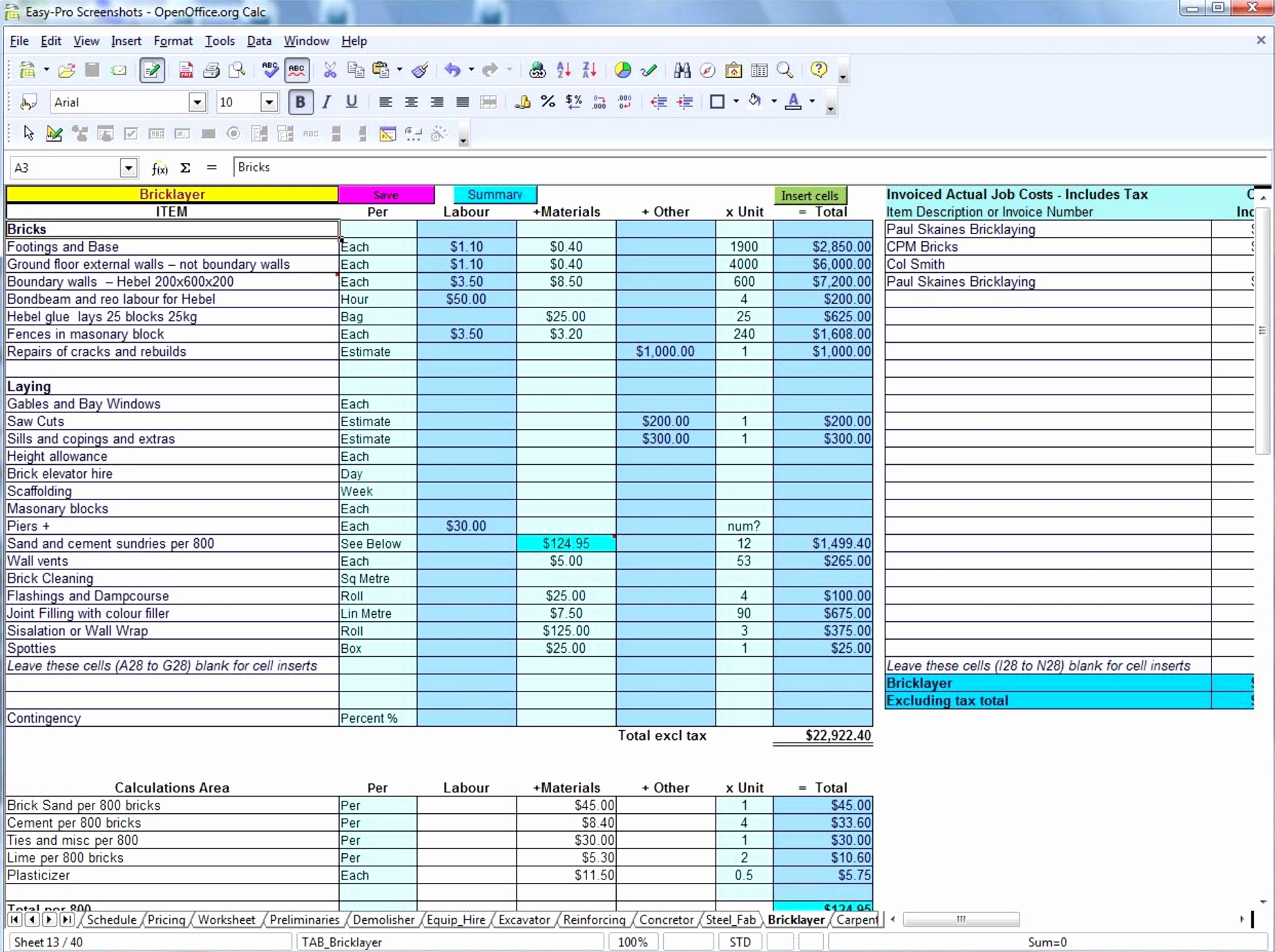

Accounts Receivable Excel Template

Accounts Receivable Excel Template

One of the key benefits of using an Excel template for accounts receivable is the ability to customize it according to the specific needs of the business. Businesses can add or remove fields, create formulas for calculations, and design the template to suit their unique requirements. This flexibility allows businesses to tailor the template to their operations and make it more efficient.

Another advantage of using an Accounts Receivable Excel Template is the ease of integration with other financial tools and software. Businesses can easily import and export data from the template to other systems, such as accounting software or CRM platforms. This can streamline the process of managing accounts receivable and ensure seamless communication between different departments.

In conclusion, an Accounts Receivable Excel Template can be a valuable tool for businesses looking to improve their cash flow management and streamline their accounts receivable process. By utilizing a template that is customizable, user-friendly, and easily integrated with other systems, businesses can enhance their financial operations and ensure timely collections from customers.