Managing debt can be a challenging task, especially when dealing with multiple loans and creditors. Keeping track of payment schedules, interest rates, and outstanding balances can quickly become overwhelming. This is where a debt schedule template in Excel can come in handy.

With a debt schedule template, you can easily organize and track all your debts in one convenient location. By inputting key information such as loan amounts, interest rates, and payment due dates, you can create a comprehensive overview of your debt obligations. This can help you stay on top of your payments and avoid costly late fees or missed payments.

Using an Excel template for your debt schedule also allows you to easily make adjustments and updates as needed. You can quickly add new loans, update interest rates, or change payment schedules with just a few clicks. This flexibility makes it easier to adapt to changes in your financial situation and stay on top of your debt repayment plan.

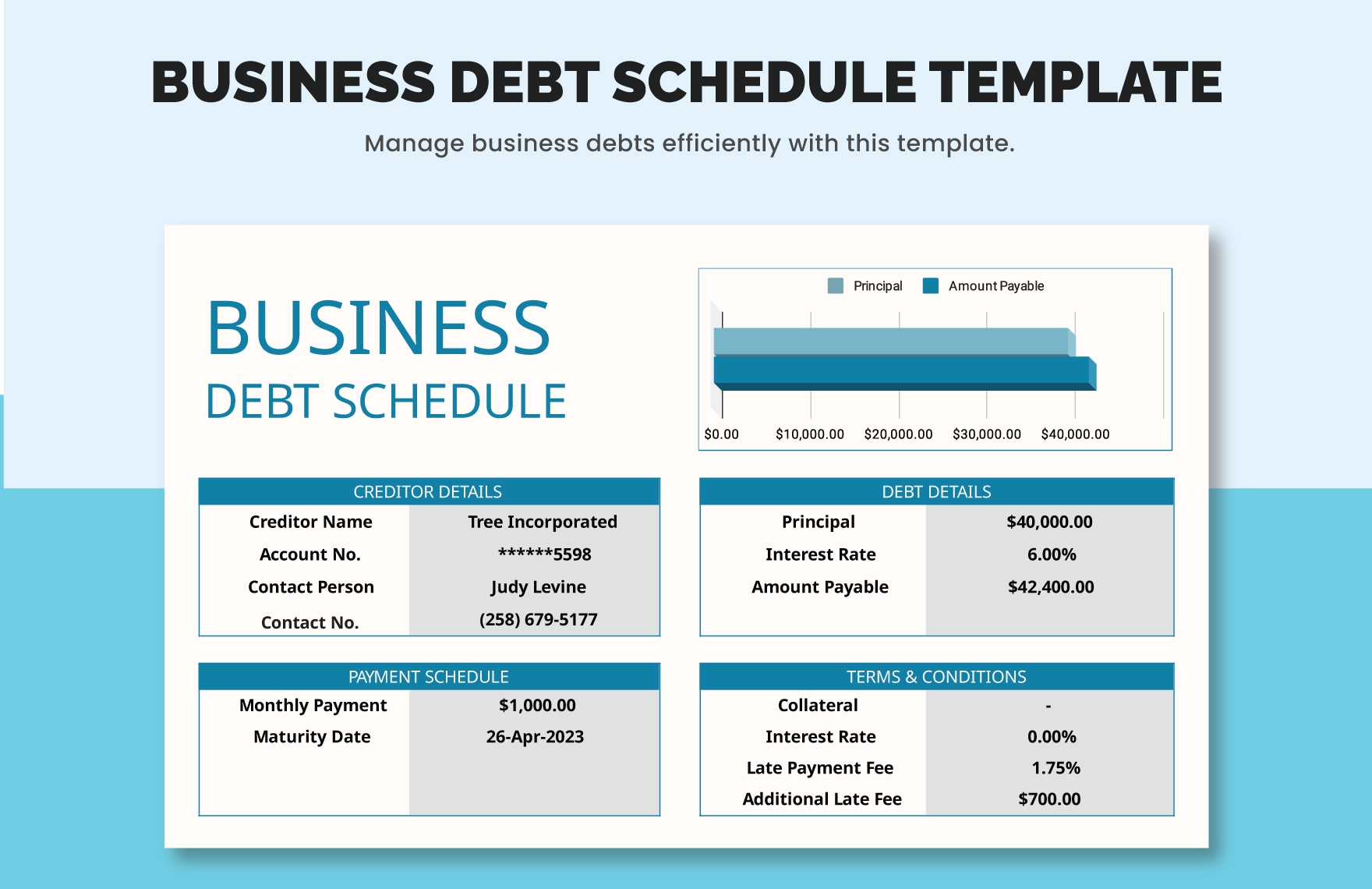

Another benefit of using a debt schedule template in Excel is the ability to generate reports and analyze your debt situation. By inputting all your debt information, you can create visual representations of your debt balances, interest payments, and payment schedules. This can help you identify areas where you can save money, prioritize debt repayment, and track your progress towards becoming debt-free.

Overall, a debt schedule template in Excel can be a valuable tool for managing your debt and staying organized. By centralizing all your debt information in one place, you can simplify the process of tracking and managing your loans. Whether you have student loans, credit card debt, or a mortgage, a debt schedule template can help you take control of your finances and work towards a debt-free future.

In conclusion, utilizing a debt schedule template in Excel can significantly ease the burden of managing multiple debts. By organizing all your debt information in one place, you can stay on top of payments, make informed financial decisions, and work towards achieving your financial goals. Take advantage of this powerful tool to take control of your debt and secure a more stable financial future.