Managing accounts receivable is crucial for the financial health of any business. One way to keep track of your receivables is by using an Excel template to generate reports. This allows you to easily track outstanding invoices, identify delinquent accounts, and monitor the overall performance of your accounts receivable department.

With an Accounts Receivable Report Template in Excel, you can streamline your invoicing process and ensure that you are getting paid on time. By organizing your receivables in a clear and concise format, you can easily identify any overdue payments and take appropriate action to collect them.

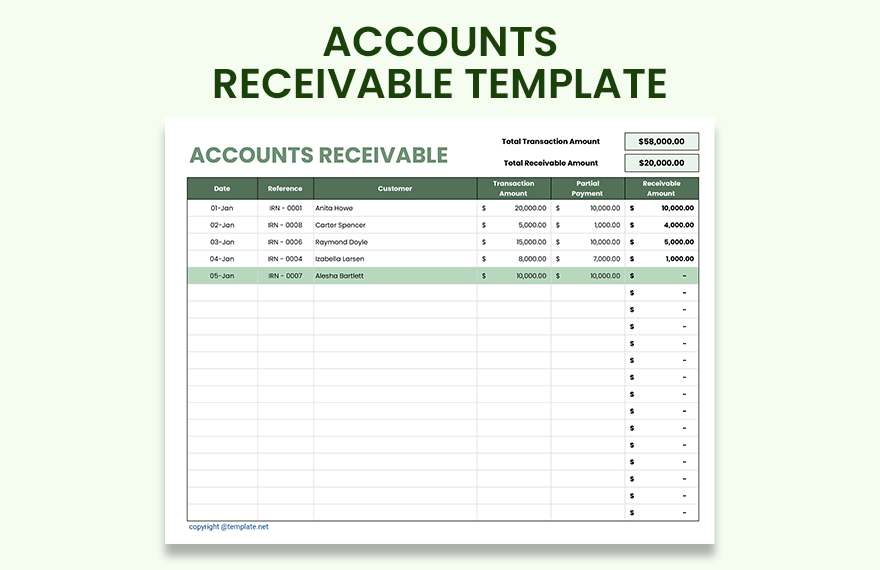

Accounts Receivable Report Template Excel

Accounts Receivable Report Template Excel

Using Excel for your accounts receivable reporting allows you to customize the template to fit the specific needs of your business. You can easily input data such as invoice numbers, due dates, amounts owed, and payment status. This flexibility makes it easy to tailor the report to your unique requirements and track the information that is most important to you.

Additionally, Excel provides the ability to generate graphs and charts based on the data inputted in the template. This visual representation can help you analyze trends, identify patterns, and make informed decisions about your accounts receivable. By using Excel’s powerful tools, you can gain valuable insights into the financial health of your business and take proactive steps to improve cash flow.

In conclusion, utilizing an Accounts Receivable Report Template in Excel is a valuable tool for any business looking to effectively manage their receivables. By tracking outstanding invoices, monitoring payment statuses, and analyzing trends, you can ensure that your accounts receivable department is operating efficiently and effectively. Take advantage of Excel’s customizable features to create a report that meets your specific needs and helps you make informed financial decisions.