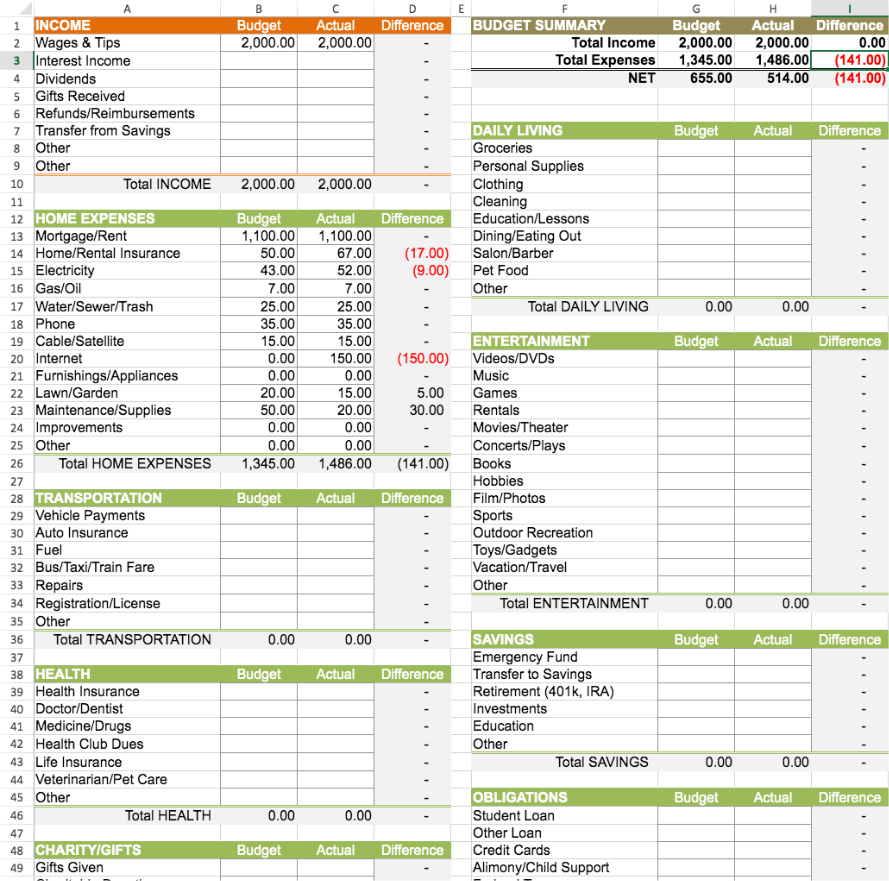

In today’s fast-paced world, managing personal finances can be a daunting task. However, with the help of a Personal Monthly Budget Template in Excel, you can easily keep track of your expenses and income, allowing you to stay on top of your financial goals.

Creating a budget is the first step towards financial stability. By using a template in Excel, you can customize categories based on your specific needs and easily input your income and expenses, giving you a clear picture of where your money is going each month.

Personal Monthly Budget Template Excel

Personal Monthly Budget Template Excel

With a Personal Monthly Budget Template in Excel, you can track your spending habits, identify areas where you may be overspending, and make necessary adjustments to ensure you are staying within your budget. This tool can also help you set financial goals and track your progress towards achieving them.

One of the key benefits of using an Excel template for budgeting is the ability to create visual representations of your financial data, such as charts and graphs. These visual aids can help you easily identify trends in your spending habits and make informed decisions about where to cut back or allocate more funds.

Another advantage of using a Personal Monthly Budget Template in Excel is the ability to easily update and modify your budget as needed. Whether your income changes, or you have unexpected expenses, you can quickly adjust your budget to reflect these changes, ensuring you always have an accurate representation of your financial situation.

In conclusion, a Personal Monthly Budget Template in Excel is a valuable tool for anyone looking to take control of their finances. By using this template, you can track your income and expenses, set financial goals, and make informed decisions about your spending habits. With the flexibility and customization options that Excel provides, managing your finances has never been easier.