Creating and maintaining a monthly budget is crucial for managing your finances effectively. One of the most popular tools for budgeting is using an Excel spreadsheet. With Excel, you can easily track your income, expenses, and savings to ensure you stay on top of your financial goals.

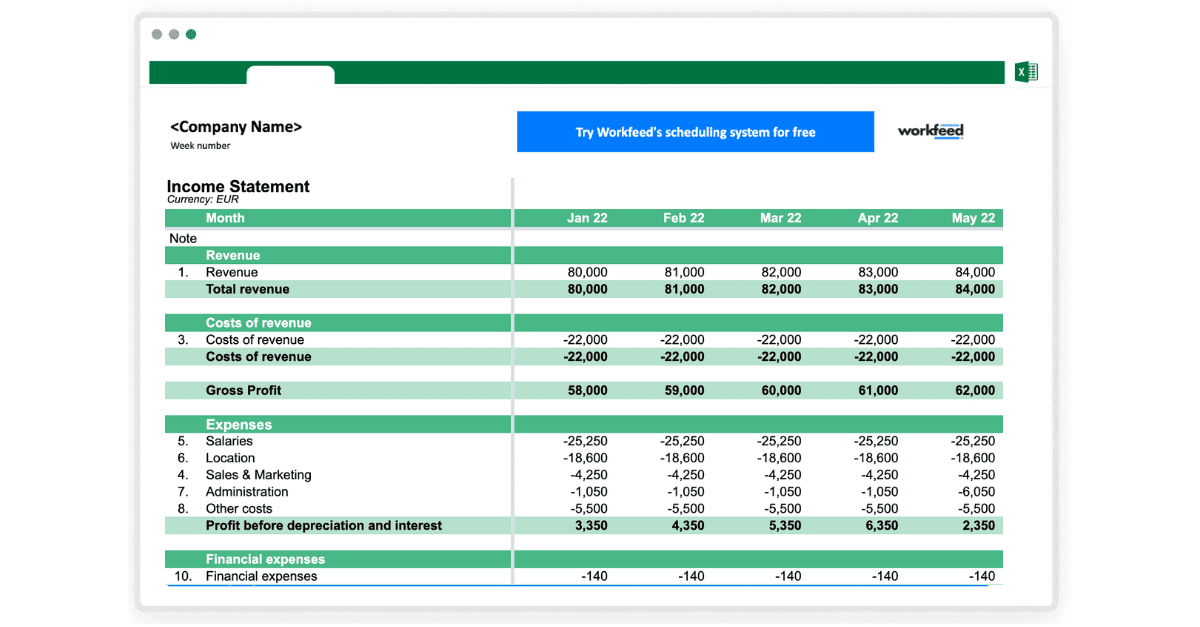

By using a monthly budget template in Excel, you can streamline the process of budgeting and have a clear overview of your financial situation. This template allows you to input your income sources, set budget goals for different categories, and track your expenses to see where your money is going each month.

With the help of Excel formulas and functions, you can calculate your total income, total expenses, savings, and even create visual representations of your budget data through charts and graphs. This makes it easier to identify areas where you can cut back on spending and increase your savings.

Moreover, the flexibility of Excel allows you to customize your budget template to suit your specific financial needs. You can add or remove categories, adjust budget amounts, and make changes to the layout to make it more user-friendly. This level of customization ensures that your budget template is tailored to your unique financial situation.

Another advantage of using a monthly budget template in Excel is the ability to track your progress over time. By saving each month’s budget data in separate worksheets, you can compare your spending habits and financial goals month-to-month. This historical data can help you make informed decisions about your finances and adjust your budget accordingly.

In conclusion, a monthly budget template in Excel is a powerful tool for managing your finances effectively. By using this template, you can track your income, expenses, and savings with ease, customize it to suit your needs, and track your progress over time. With a well-maintained budget, you can achieve your financial goals and secure a stable financial future.