Journal entries are crucial for businesses to keep track of their financial transactions accurately. With the help of Excel, you can create a template that simplifies the process of recording these entries. This template can save time and reduce errors in your accounting records.

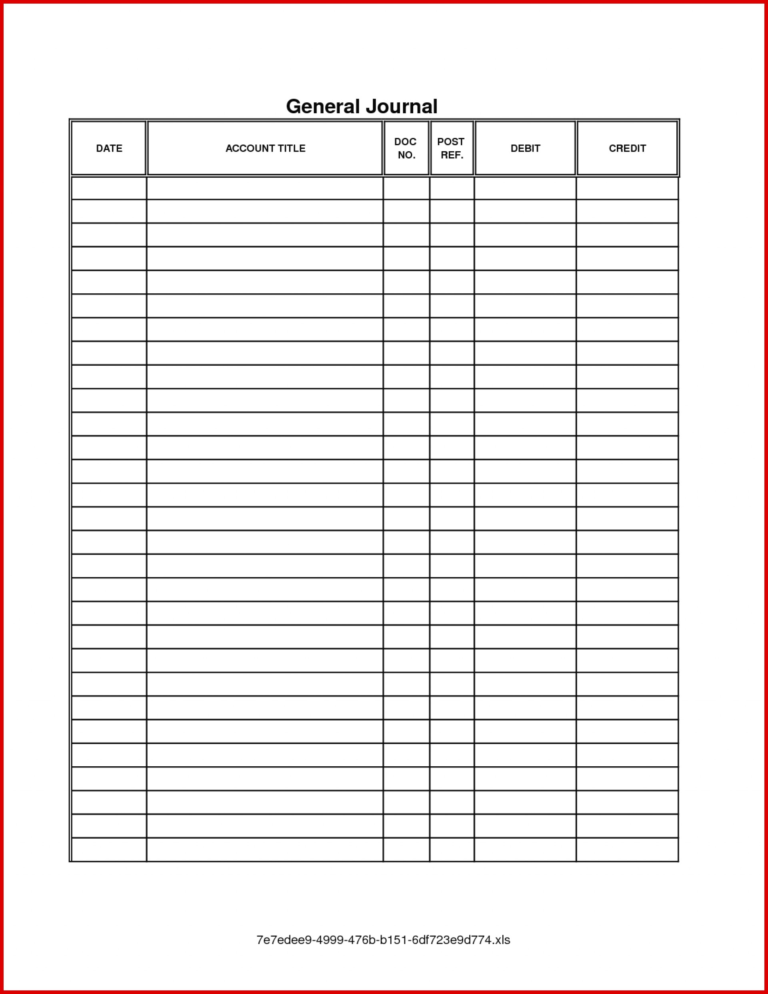

By using an Excel journal entry template, you can easily input the necessary information such as date, account name, debit or credit amount, and a brief description of the transaction. This organized format allows for efficient data entry and retrieval, making it easier to analyze your financial data.

One benefit of using an Excel journal entry template is the ability to customize it to fit your specific business needs. You can add or remove columns, change the layout, or include formulas to automatically calculate totals. This flexibility allows you to tailor the template to your accounting requirements.

Another advantage of using Excel for journal entries is the ability to create multiple templates for different types of transactions. For example, you can have separate templates for revenue, expenses, assets, and liabilities. This segregation helps in maintaining a clear and organized record of all financial activities.

Moreover, Excel provides features such as sorting and filtering that make it easy to search and analyze journal entries. You can quickly find specific transactions, track changes over time, and generate reports for decision-making purposes. This efficient data management tool enhances the overall financial management process.

In conclusion, utilizing an Excel journal entry template can streamline your accounting processes and improve the accuracy of your financial records. By customizing the template to suit your business requirements and taking advantage of Excel’s features, you can effectively manage your journal entries and make informed financial decisions. Incorporating this tool into your accounting practices can lead to greater efficiency and transparency in your financial management.