Excel templates are a great tool for small businesses and individuals looking to streamline their accounting processes. With the right template, you can easily track income and expenses, create financial statements, and stay organized throughout the year. One popular use of Excel templates is for accounting purposes, as they provide a structured format for recording financial data.

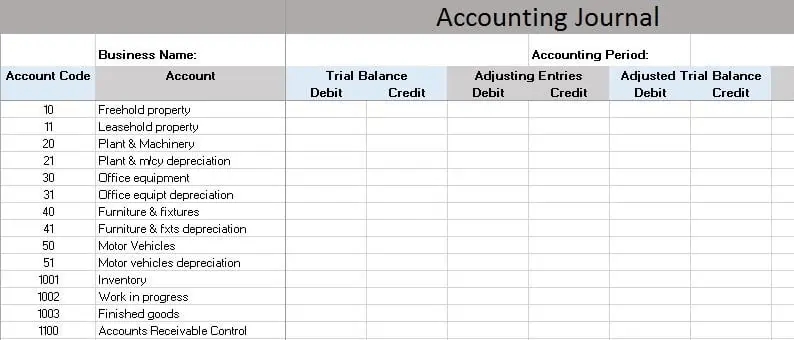

Accounting templates in Excel typically include sections for income, expenses, assets, liabilities, and equity. These templates can be customized to fit the specific needs of your business, allowing you to track everything from sales revenue to payroll expenses. By using a template, you can save time and reduce errors in your financial reporting.

One advantage of using Excel templates for accounting is the ability to easily generate financial reports. With the click of a button, you can create balance sheets, income statements, and cash flow statements. This can be especially helpful when preparing for tax season or meeting with investors, as it allows you to quickly assess the financial health of your business.

Another benefit of Excel templates is the flexibility they offer. You can add or remove columns, customize formulas, and format cells to meet your specific accounting needs. This level of customization can help you track key performance indicators, monitor trends, and make informed business decisions based on your financial data.

In conclusion, Excel templates for accounting are a valuable tool for small businesses and individuals looking to improve their financial management practices. By using a template, you can streamline your accounting processes, generate accurate financial reports, and make informed decisions about the future of your business. Whether you are tracking expenses, monitoring revenue, or preparing for tax season, an Excel template can help you stay organized and in control of your finances.