Creating a balance sheet is an essential part of managing the financial health of any business. It allows you to see at a glance the assets, liabilities, and equity of your company. Using an Excel template for your balance sheet can make this process much simpler and more organized.

With a simple balance sheet template in Excel, you can easily input your financial data and have it automatically calculated for you. This can save you time and reduce the risk of errors in your financial statements. Whether you are a small business owner or a financial professional, having a well-designed balance sheet template can help you stay on top of your finances.

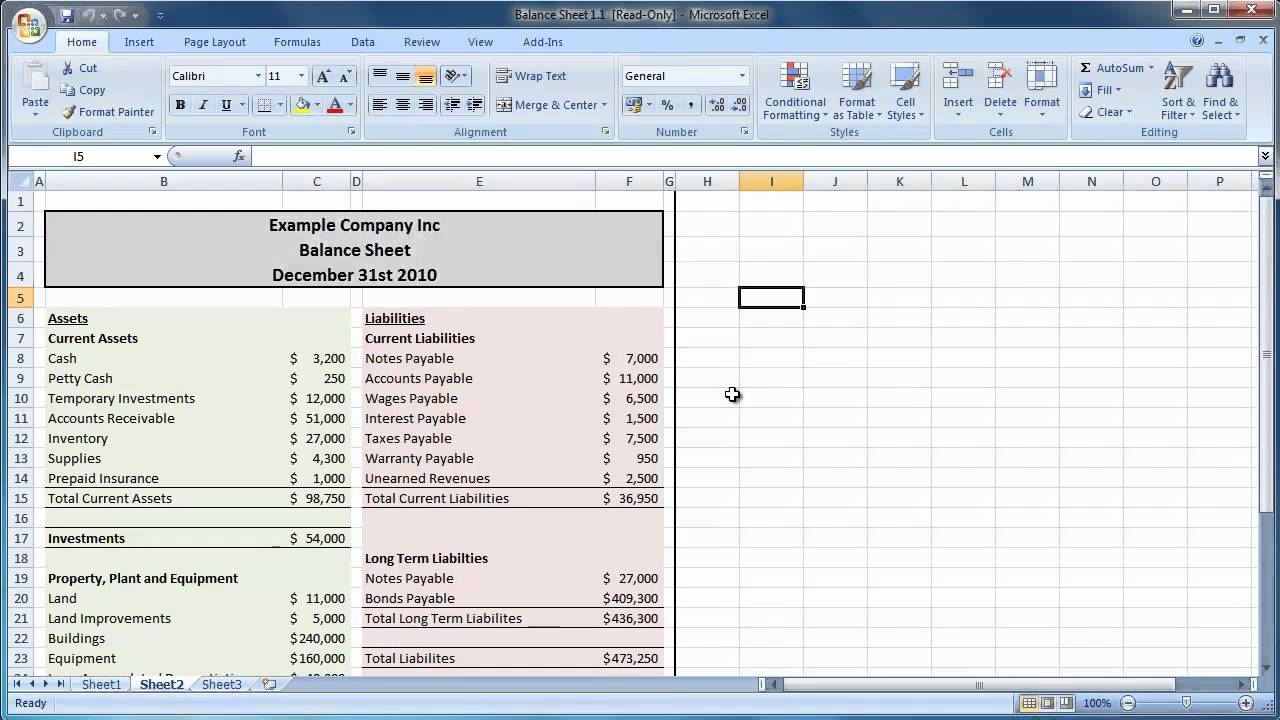

Simple Balance Sheet Template Excel

Simple Balance Sheet Template Excel

When using a balance sheet template in Excel, you can customize it to suit the specific needs of your business. You can add or remove categories, change the formatting, and even create graphs and charts to visualize your financial data. This flexibility allows you to tailor the template to best represent the financial health of your company.

Another benefit of using an Excel template for your balance sheet is the ability to easily update and track changes over time. By regularly inputting your financial data into the template, you can see how your assets, liabilities, and equity are changing month to month or year to year. This can help you make more informed decisions about your business and identify any areas that may need attention.

In conclusion, a simple balance sheet template in Excel can be a valuable tool for managing the financial health of your business. It provides a clear and organized way to track your assets, liabilities, and equity, and allows you to easily customize and update your financial data. By utilizing this template, you can ensure that your business stays on track financially and make informed decisions for the future.