Running a small business involves keeping track of various expenses to ensure financial stability and growth. One way to effectively monitor and manage expenses is by using a printable expense report. This tool allows small business owners to record all business-related costs and analyze them to make informed decisions.

With a small business printable expense report, entrepreneurs can easily categorize expenses, such as office supplies, utilities, travel, and marketing, among others. This structured approach helps in identifying areas where costs can be minimized or optimized for better financial performance. Additionally, having a documented record of expenses is essential for tax purposes and financial audits.

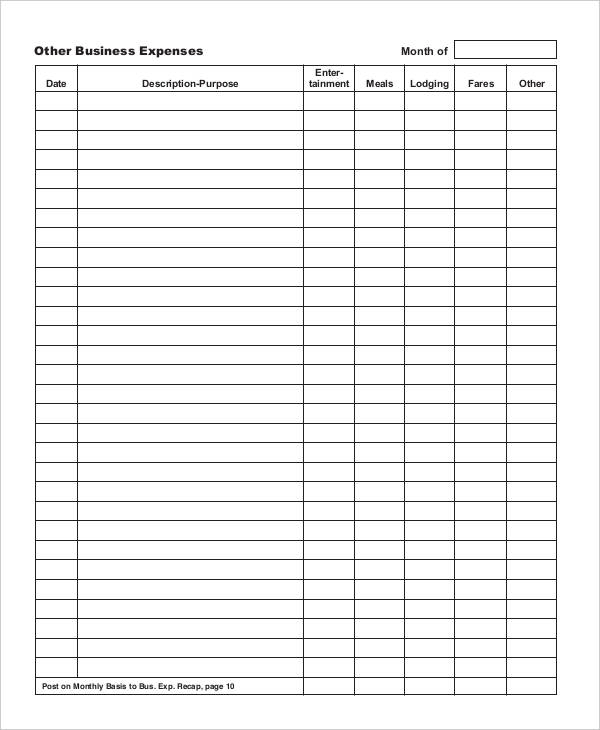

Small Business Printable Expense Report

Small Business Printable Expense Report

Creating a printable expense report template tailored to the specific needs of the business can streamline the process of tracking expenses. The template should include fields for date, description of expense, amount, category, and any relevant notes. By regularly updating this report, small business owners can gain insights into their spending patterns and make necessary adjustments to improve profitability.

Utilizing a printable expense report also promotes transparency and accountability within the organization. Employees who are authorized to incur business expenses can use the report to document their spending and seek approval from management when necessary. This helps in maintaining control over the budget and preventing unauthorized expenditures.

In conclusion, a small business printable expense report is a valuable tool for managing finances effectively and ensuring business success. By implementing this tool, entrepreneurs can track expenses efficiently, analyze spending trends, and make informed decisions to optimize their financial resources. With a structured approach to expense management, small businesses can achieve greater financial stability and growth in the long run.