Managing your finances is an important aspect of adulting, and one key component of that is keeping track of your daily expenses. By monitoring where your money is going each day, you can make informed decisions about where to cut back and where to allocate more funds. One helpful tool for this task is a printable daily expenses log.

With a printable daily expenses log, you can easily jot down all your expenses throughout the day, whether it’s a cup of coffee, a lunch out with friends, or a new pair of shoes. By recording each expense, you will have a clear picture of your spending habits and can identify areas where you may be overspending.

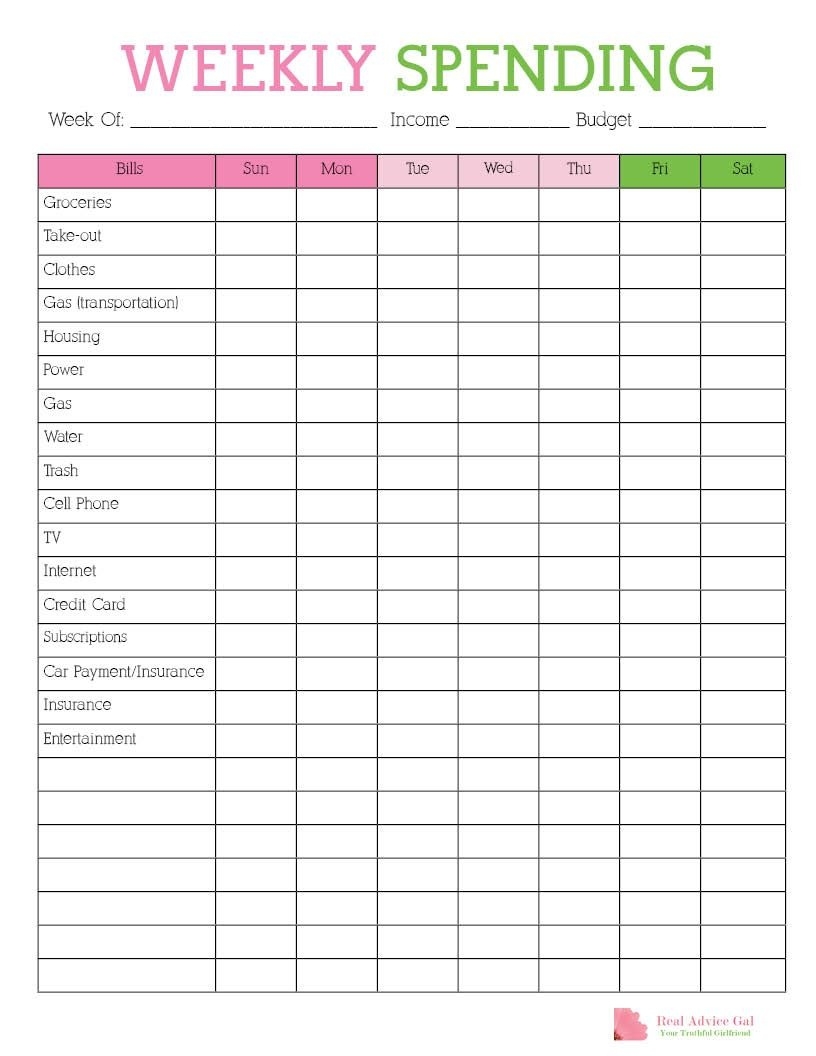

Printable Daily Expenses Log

There are many templates available online for printable daily expenses logs that you can download and use for free. These logs typically include columns for the date, description of the expense, category (such as groceries, transportation, entertainment, etc.), and amount spent. Some logs even have a space to note whether the expense was paid for with cash, credit card, or debit card.

Using a printable daily expenses log can help you stay organized and accountable for your spending. It provides a visual representation of your daily expenses, which can be eye-opening for many people. You may be surprised to see how much those small, daily purchases add up over time.

By consistently tracking your daily expenses, you can identify patterns in your spending and make adjustments as needed. For example, if you notice that you are spending a significant amount of money on dining out each week, you may decide to cook more meals at home to save money. Or if you see that your transportation costs are higher than expected, you could explore alternative modes of transportation to cut back on expenses.

In conclusion, a printable daily expenses log is a valuable tool for anyone looking to take control of their finances. By keeping track of your daily expenses, you can make more informed decisions about your spending habits and work towards achieving your financial goals. So why not give it a try and see how it can help you better manage your money?