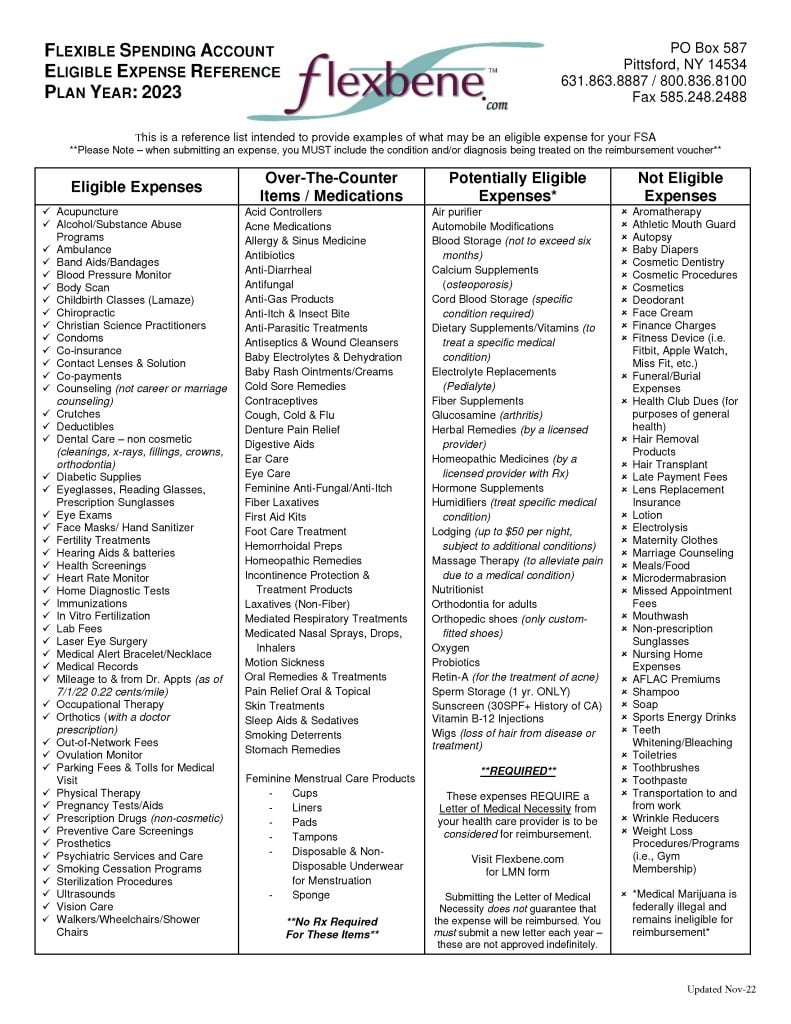

Flexible Spending Accounts (FSAs) are a great way to save money on eligible healthcare expenses. However, it can be challenging to keep track of what expenses are considered qualified for reimbursement. That’s why having a printable list of FSA qualified expenses for 2019 can be incredibly helpful.

With a printable list, you can easily reference which medical, dental, and vision expenses are eligible for reimbursement through your FSA. This can save you time and hassle when submitting claims and ensure that you are maximizing the benefits of your FSA.

Fsa Qualified Expenses Printable List 2019

Fsa Qualified Expenses Printable List 2019

Here is a breakdown of some common FSA qualified expenses for 2019:

- Prescription medications

- Doctor’s office visits

- Dental cleanings and procedures

- Eye exams and prescription glasses or contacts

- Medical equipment such as crutches or blood pressure monitors

It’s important to note that not all healthcare expenses are eligible for reimbursement through your FSA. Expenses such as cosmetic procedures, vitamins, and over-the-counter medications (without a prescription) are typically not considered qualified expenses.

By utilizing a printable list of FSA qualified expenses for 2019, you can stay organized and ensure that you are making the most of your FSA benefits. Be sure to consult with your FSA administrator or benefits provider if you have any questions about eligible expenses or reimbursement procedures.

With the help of a comprehensive list, you can easily track your eligible expenses and make the most of your FSA funds. By staying informed and organized, you can take full advantage of the tax benefits offered by your FSA and save money on your healthcare expenses.

Conclusion

Having a printable list of FSA qualified expenses for 2019 can be a valuable resource for individuals looking to maximize their healthcare savings. By understanding which expenses are eligible for reimbursement, you can make informed decisions about your healthcare spending and ensure that you are using your FSA funds effectively. Stay organized, consult with your benefits provider, and take advantage of the tax benefits offered by your FSA.