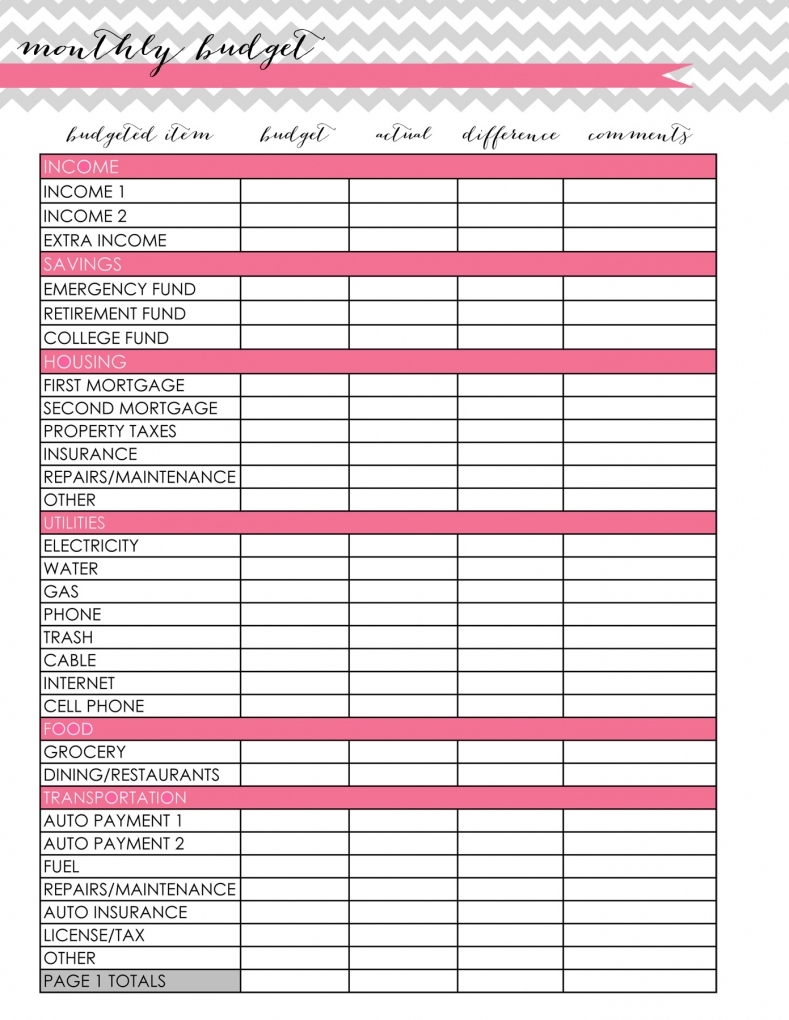

Keeping track of your monthly expenses is essential for effective budgeting and financial planning. By using a monthly expenses list printable, you can easily organize and monitor your spending to ensure you stay within your budget.

With a printable expenses list, you can categorize your expenses such as groceries, utilities, rent/mortgage, transportation, and entertainment. This allows you to see where your money is going each month and identify areas where you can cut back or make adjustments.

Monthly Expenses List Printable

Monthly Expenses List Printable

Benefits of Using a Monthly Expenses List Printable

One of the main benefits of using a monthly expenses list printable is the convenience and ease of tracking your spending. You can simply fill in the amounts for each expense category and total them up at the end of the month. This helps you see the bigger picture of your financial habits and make informed decisions about your spending.

Another advantage is that a printable expenses list can serve as a visual reminder of your financial goals. By seeing your expenses laid out in front of you, it can motivate you to stick to your budget and save for important financial milestones such as a vacation, home renovation, or retirement.

Additionally, a monthly expenses list printable can help you identify any patterns or trends in your spending. For example, you may notice that you consistently overspend on dining out or impulse purchases. With this information, you can take steps to curb these habits and allocate more money towards savings or debt repayment.

Lastly, a printable expenses list can also be a useful tool for couples or families to track their joint expenses and work towards common financial goals. By sharing and discussing the list together, you can improve communication about money matters and ensure everyone is on the same page regarding spending priorities.

In conclusion, a monthly expenses list printable is a valuable resource for anyone looking to take control of their finances and make smarter money decisions. By using this tool to track your spending, set goals, and make adjustments as needed, you can achieve greater financial stability and peace of mind.