In today’s fast-paced world, managing expenses efficiently is crucial for individuals and businesses alike. Keeping track of credit card expenses is essential for budgeting and financial planning. One way to simplify this process is by using a printable credit card expense report.

Printable credit card expense reports offer a convenient way to record and organize your spending. Whether you’re a business owner tracking employee expenses or an individual managing personal finances, these reports can help you stay on top of your financial transactions.

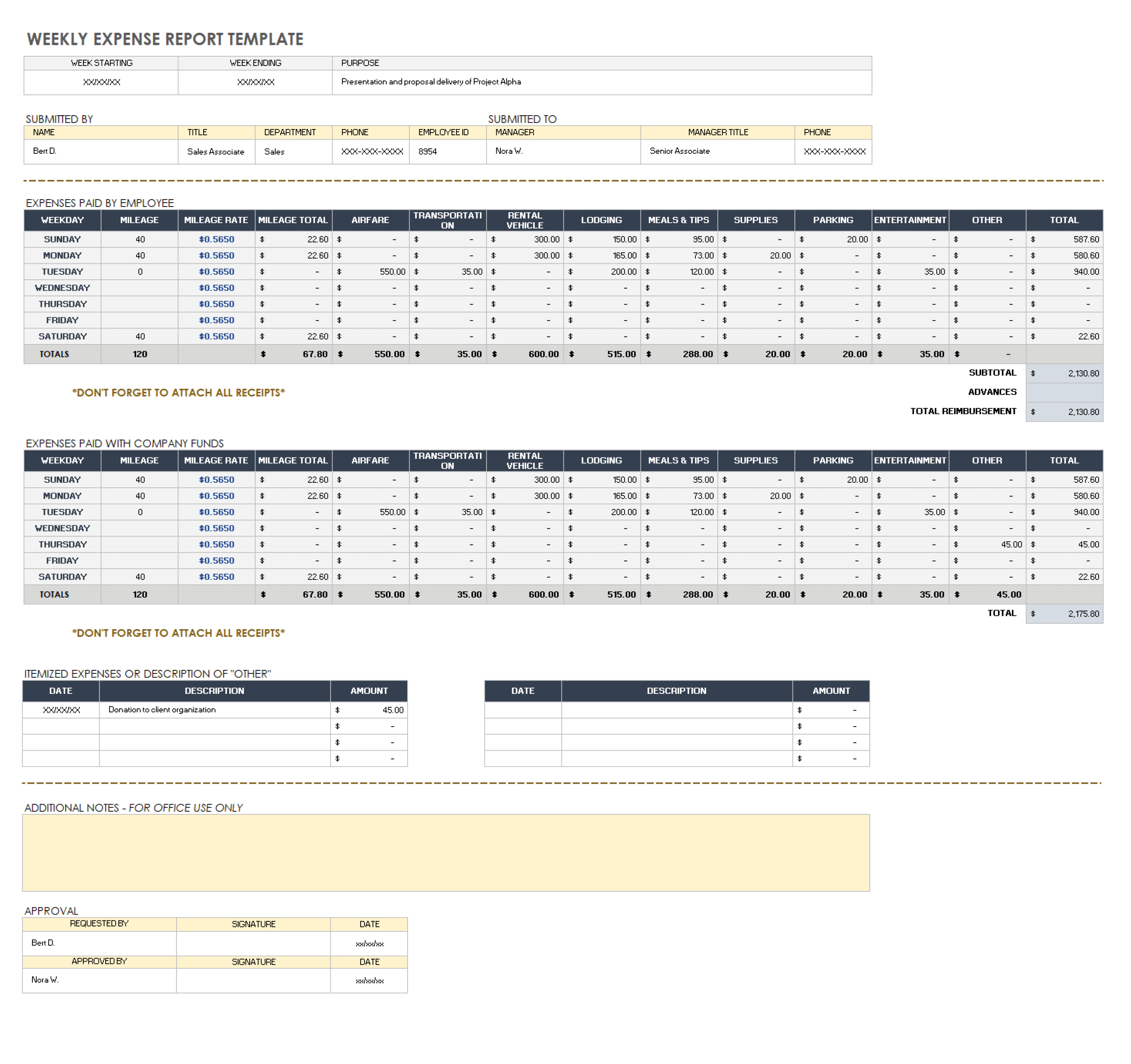

Printable Credit Card Expense Report

Printable Credit Card Expense Report

Benefits of Using a Printable Credit Card Expense Report

1. Organization: By using a printable credit card expense report, you can categorize your expenses and keep them organized. This makes it easier to track where your money is going and identify areas where you can cut back.

2. Budgeting: Creating a budget is essential for financial stability. With a printable credit card expense report, you can compare your actual expenses to your budgeted amounts. This allows you to make adjustments as needed and avoid overspending.

3. Tax Preparation: Keeping accurate records of your expenses is crucial during tax season. A printable credit card expense report can help you easily identify deductible expenses and streamline the tax preparation process.

4. Accountability: For businesses, printable credit card expense reports can hold employees accountable for their spending. By requiring employees to submit detailed expense reports, businesses can ensure that funds are being used appropriately.

5. Financial Planning: By analyzing your credit card expenses with a printable report, you can gain insights into your spending habits and make informed decisions about your financial future. Whether it’s saving for a big purchase or planning for retirement, a clear picture of your expenses is essential.

In conclusion, a printable credit card expense report is a valuable tool for anyone looking to take control of their finances. By using this report to track and analyze your expenses, you can make better financial decisions and achieve your financial goals.